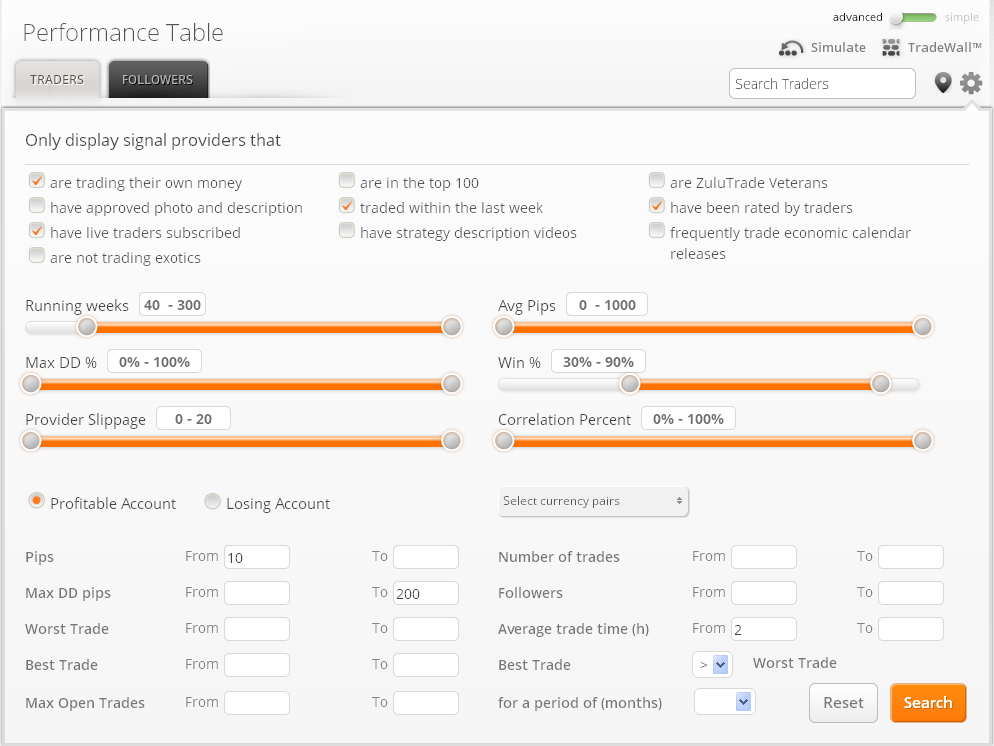

Zulu trade offers the biggest variety of indicators for filtering the traders – the advanced search allows configuring up to 28 performance indicators. The goal of analyzing and filtering the indicators is finding the best balance of risk Vs reward. As these are two different and broad variables both influenced by many factors – the best way is not by looking at separate indicators but by analyzing them in context with each other. First of all you must understand that you can not blindly rely on the top traders list! Copying other trades is not a complete walk on the beach and you must invest some time and effort to find really reliable traders. Here are the TOP 10 rules for finding the best traders and avoiding the risky ones:

- Observe the correlation of “winning trades %” Vs “Max Open trades”. Just watching at winning trades can be misleading – perhaps the trader is randomly opening trades with very wide stop losses and not closing the losing ones (known as Scaling out trades).

- Don’t look just at the DrawDown percentage rate! It might sometimes be misleading, so always check the drawdown tab to see how it looks in pips as it could be many hundred pips even with a low percent rate.

- Look for reasonable winning percentage – the closer to 100% it is the riskier! The recommended normal percentage is 55% – 75%.

- One of the first indicators to look for is the ROI (return on investment). If it is above 300% and other indicators are not contradicting it then it’s a potentially good trader. Still this shouldn’t be the single argument as there are traders who artificially increase their ROI by using several demo accounts to boost the statistics, so use all the indicators mentioned here as a united checklist.

- Go for traders with experience. 40 – 52 running weeks (1 year) is a good benchmark.

- Choose traders whose average profit is not less than 9 pips. Small profit per deal means they are scalping which could make you lose money (break even in the best scenario) due to spreads and slippage.

- Avoid those signal providers whose profit is around 100 000 pips and more, this is a signal that they might be doing something weird.

- Be careful of traders who have more than 10 open trades. Many open trades might be risky. Such traders use a strategy called Martingale strategy – opening many short positions with small sizes and small pip differences between them. The problem with this strategy is that it is quite risky. But there are of course honest and successful traders who manage 10 and more trades as they mix intra-day and multi-day trading.

- Observe the profit/drawdown chart (under the „Drawdown” tab). Normally the smoother it is – the more stable the trader. But ups and downs are not always a bad sign – also good traders can have down times and the swings show that the trader is not cheating on the results. Watch out for a line that starts high and then either stays horizontal or goes down – this might be a sign that they performed some manipulations in the beginning to boost statistics.

- In case if you are not 100% sure about a signal provider do not allow them more than 1 lot per trade and limit the order amount to 1 or 2 per signal provider in the beginning

And a bonus advice to lower risk: choose traders with different time frame and currency pair strategies! You must have a portfolio of traders who trade short term, long term trades and different currency pairs – this is called a diversified portfolio. So do not put all your money in one trader. Variety is the key to sustainable success!

Figure 1 – An example of optimal advanced search settings in Zulu trade.

NB! even when all these indicators are filtered out perfectly you should be attentive. Even traders with excellent and natural ROI’s occasionally blow their accounts. And separate indicators do not always depict the actual professionalism of a trader as most of these indicators are just averages and the market situation can change. So observe the statistics as a whole system, in correlation with each other to find a perfect balance that suits your needs and don’t put all your resources in one trader unless he has proven himself to you over a sufficient period of time. You should have a mix of several traders in your portfolio to leverage the risks. That’s why social trading is also called “the process of creating a portfolio of traders”.

Remember that the best proof is what results a trader is bringing to your account, not his statistics!

So, first open a demo account and see how it goes with different traders.