Best Social Trading Platforms

Currently, the most popular social trading platform in the world is eToro with more than 20 million active users. Other examples of social trading platforms are Tradeo and Zulutrade.

How Social investment Networks work

What is Social Trading?

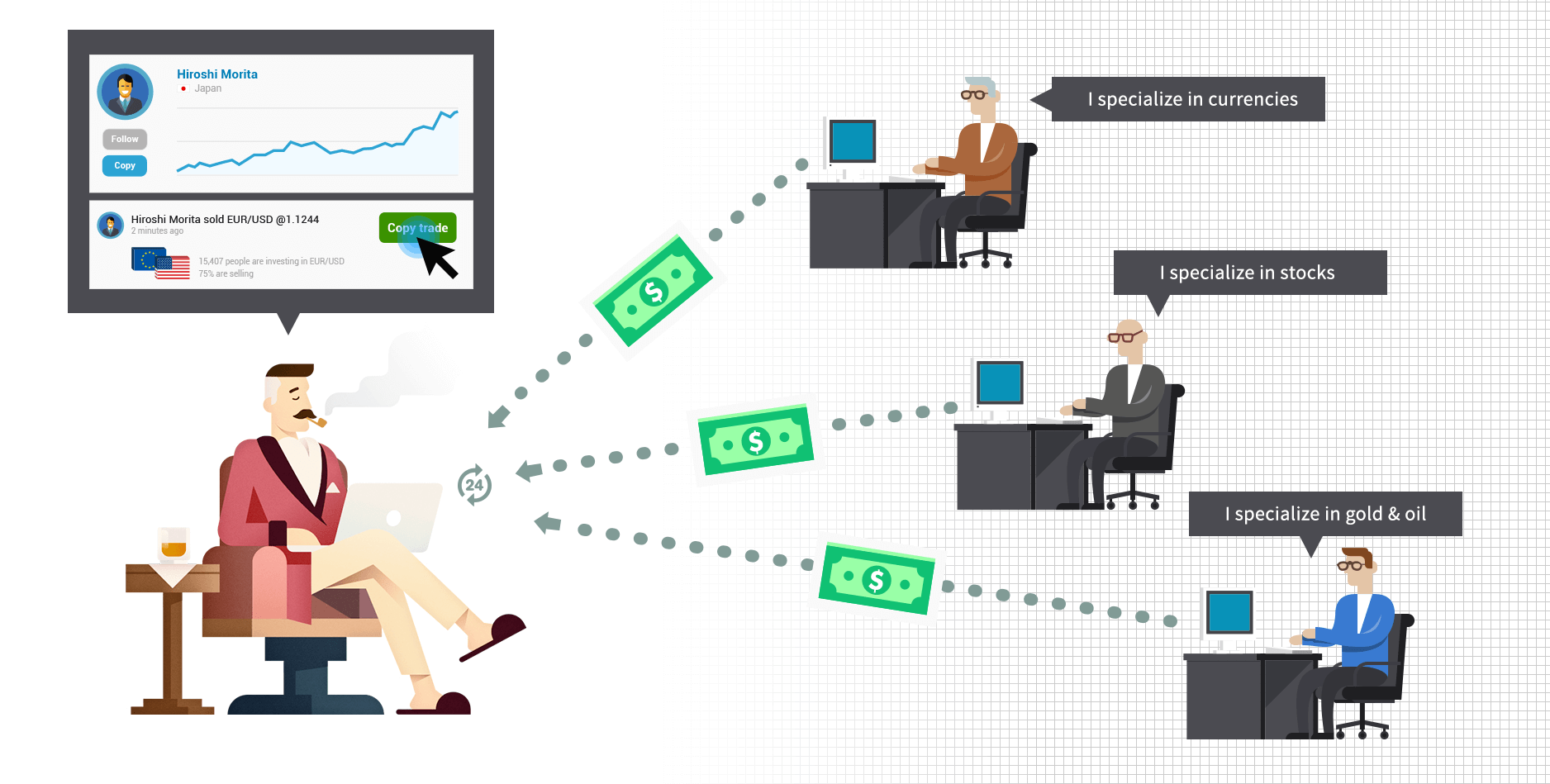

With Social Trading you can follow experienced traders and copy their trades.

This is very useful for beginners want to learn the ropes and get advice from traders who have been in the game longer.

Social investment networks unite thousands and millions of traders in a friendly environment where anyone can tap into the wisdom of crowd.

Best strategies are no longer kept secret but shared as the guru traders/signal providers earn commissions by the amount of followers and copiers they have or by the amount of copied deals.

Followers can see detailed performance statistics of the seasoned traders, ask them questions, read their discussions and posts.

With a click of a button one can copy individual or all trades of a preferred trader.

The positions are opened proportionally, meaning that if the followed trader opens a position of 1000 $ which constitutes 5% of their account, the copier will also enter with 5% of his smaller account thus greatly minimizing exposure to risk.

The main idea of Social trading networks.

The target of a social trading network’s user is to create a portfolio of experienced traders who then make money for the user and themselves.

This portfolio has to be picked wisely and diversely so that there are traders with different risk appetites, strategies and favorite currency pairs.

Short history of Trading social Networks

2000’s – First trade copying companies are born. This service is called Mirror Trading and it accumulates best trader deals and lets people create mirroring accounts. Not many options of adjustments are available and there are quite a lot of errors and slippages in the systems.

2006 – Zulu Trade is launched with a slightly improved system allowing users to manage some risk control parameters.

2008 – Economic crisis hits the whole world. Stock markets go in a recession and more and more people (both investors and ordinary humans) turn to forex as it is the only market that not only avoided crisis but allowed to make profit from it.

2009 – Seeing the great potential and interest for the exchange market from people with no experience in trading many forex brokers integrate social trading into their systems. The most popular social system developer is Tradency whose platform is built-in by many brokers in 2009, 2010 and next years. Unfortunately there still are a lot of problems in the systems as it is very challenging to synchronize many thousand trades in real-time.

2011 – Etoro introduces Copy Trader which sets a new benchmark for social trading. It clearly stands out from the crowd opening the doors of currency trading to large audiences allowing beginners to tap into the wisdom of crowds. The system is made radically more simple, intuitive and enjoyable than any forex platform out there. It is more like a Facebook for traders where people can follow the best investors, interact with them, see all their transactions live and copy their trades. But there are still occasional hiccups in the system at this early phase and some of the guru traders are cheating to get higher rankings.

2012, 2013 – Both Etoro and Zulu Trade keep investing large resources to improve their social platforms. Influenced by the success of Etoro, Zulu also redesigns the whole platform making it also more visually appealing. Zulu continues to expand and add new brokers to its system as it allows users to copy traders from different platforms, not only Zulu’s. Having signal providers from different platforms is Zulu’s strongest competitive advantage. Etoro keeps steady focus on delivering the best user experience, wins awards and seems to be working on preventing the rating manipulations of the guru traders.

The Verdict

The very idea of social trading is great! In the real life there are of course some bumps along the road and you must be careful, but these bumps are becoming less significant with each software upgrade and there are ways to solve these issues related with the human factor.

Nowadays the best social platforms provide advanced and detailed tools for filtering traders. Users can filter traders and signal providers by multiple aspects of trading style, results and choose the safest ones. Still these filters can’t guarantee 100% security and you shouldn’t carelessly rely on them.

After all, every business and investment opportunity requires some effort, and social trading is no exception – money doesn’t grow on trees and you have to be cautious and analyze your actions carefully.

That being said, social trading is becoming the best way for beginner traders to dip their toes in the markets and learn from experienced traders.

See TOP trader Rankings

See the TOP Trader RankingStart Trading with eToro

Start Trading51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

__