FXCM review

Web: www.fxcm.com

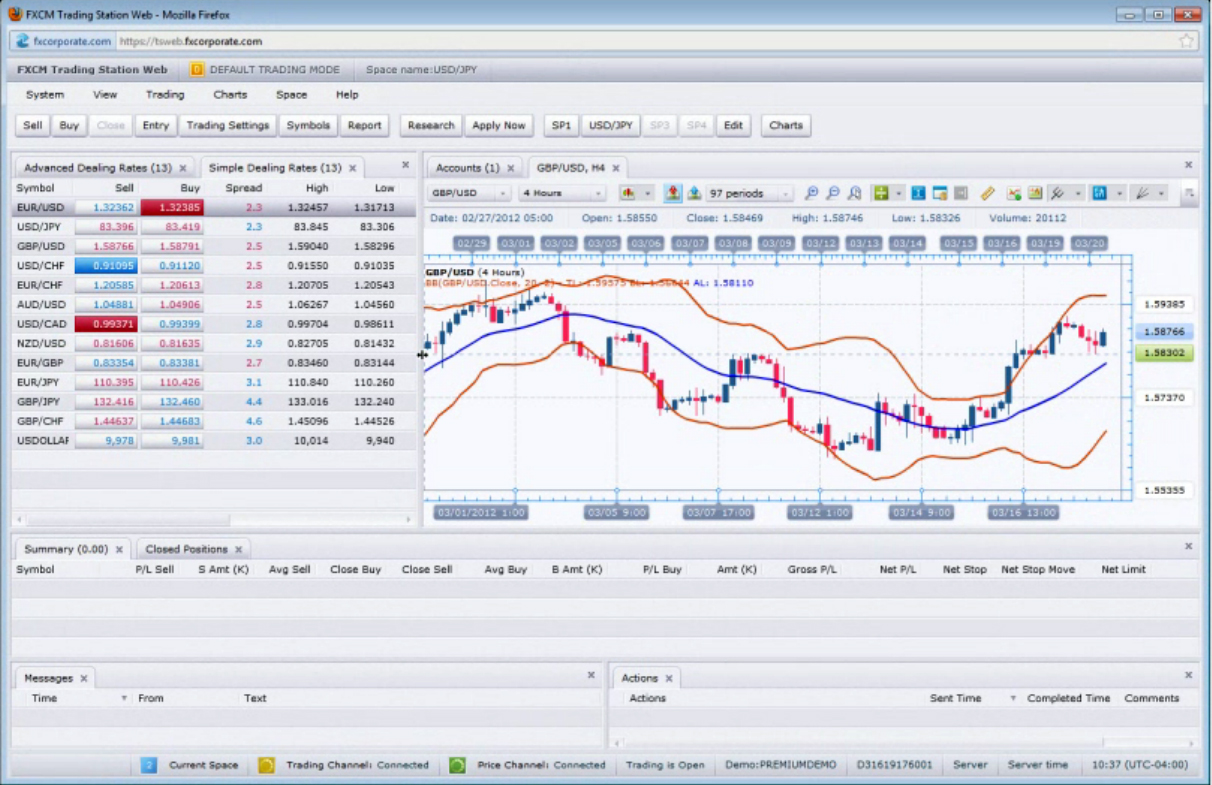

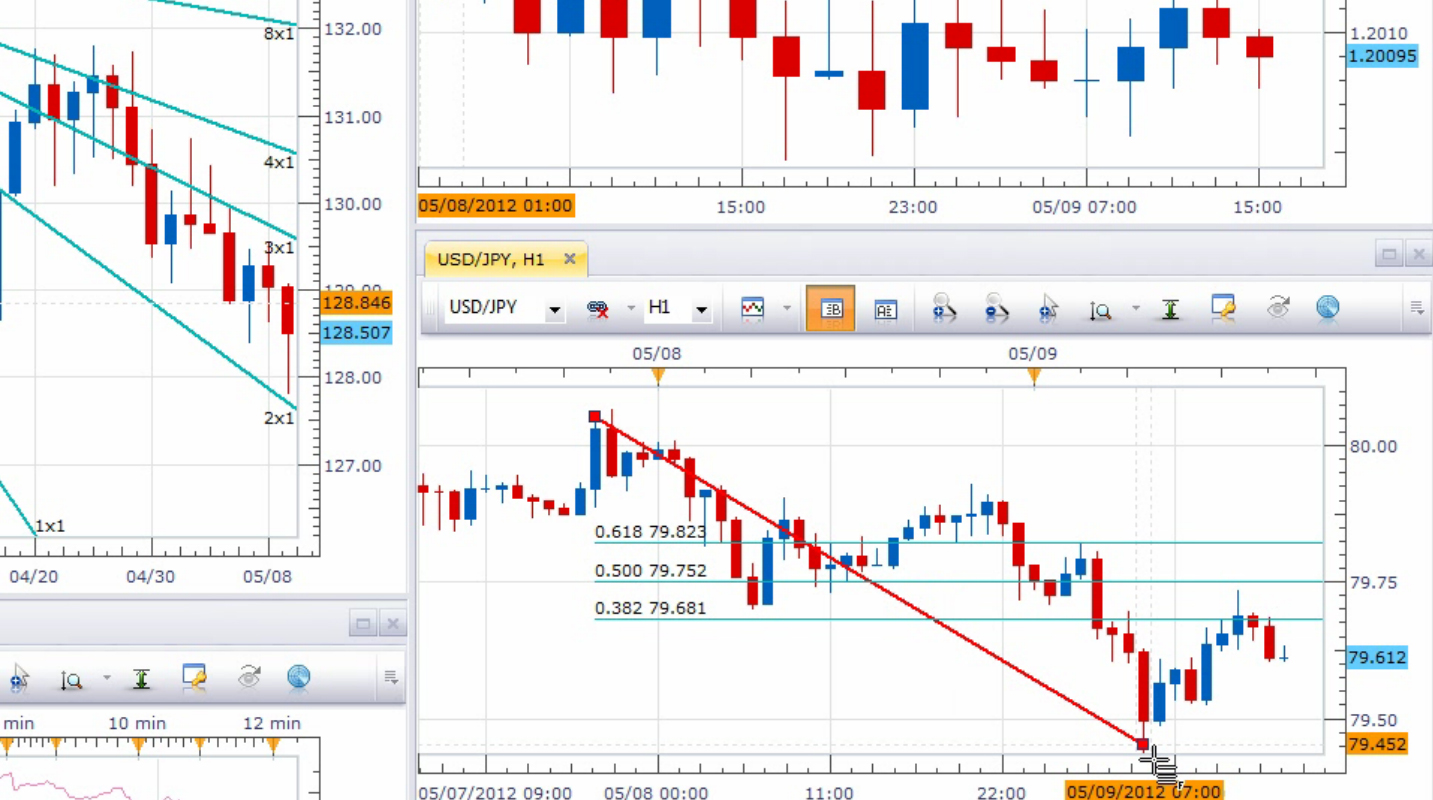

FXCM is one of the most trusted, awarded and heavily regulated forex brokers. FXCM was the first broker to be listed on the NY Stock exchange thus becoming one of the most transparent and honest industry players.The best part about FXCM is that it offers a choice between Dealing Desk and No Dealing Desk execution type accounts. So traders can choose between having more stable executions and no interventions of the No Dealing Desk (NDD) or lower spreads of the Dealing Desk (DD) model. The NDD account allows traders to perform high frequency (scalping) trading and news trading as there are no delays and interventions and the positions are processed instantly and automatically. Unlike many other brokers who have just a single liquidity provider FXCM has an advanced system of providing the best spreads by comparing and choosing the best offers from multiple (>10) sources like global banks, financial institutions and other market makers. This allows to benefit from very competitive spreads. FXCM does not make profits from their clients losses, they get compensated with a 1 pip markup on the spread. FXCM offers one of the best variety of available trading platforms suited for all needs and situations. The desktop version of trading platform is not only friendly for beginners but has some serious professional analytic and charting tools under the hood offering built-in strategies, customisable interface and automated signals.

[icon name=icon-graph] Detailed rating

[icon name=icon-star] Awards

[icon name=icon-th] 2013 FX STREET – BEST SELL-SIDE ANALYSIS CONTRIBUTOR: DAILYFX

[icon name=icon-th] 2012 FOREX MAGNATES – BEST PROPRIETARY FX PLATFORM

[icon name=icon-th] 2012 INVESTMENT TRENDS – LARGEST FOREX PROVIDER

[icon name=icon-th] 2011 FXSTREET – BEST FX AWARDS – BEST BROKER RESEARCH TEAM: DAILYFX

[icon name=icon-th] 2010 FX TRADERS’ CHOICE AWARDS – EAGLE AWARD: BEST FX BROKER

[icon name=icon-th] 2010 WHAT INVESTMENT MAGAZINE – READERSHIP AWARDS – BEST FX PROVIDER 2010

[icon name=icon-key] Key figures

[icon name=icon-arrow-right] Founded: 1999

[icon name=icon-arrow-right] Headquarters: New York (USA)

[icon name=icon-arrow-right] Regulated by: NFA & CFTC (USA), FSA (UK) SFC (Japan), ASIC (Australia), CONSOB (Italy), DGCX (Dubai), BaFIN (Germany), ACP (France), AMF (France)

[icon name=icon-arrow-right] Minimum Deposit: $50

[icon name=icon-arrow-right] EUR/USD spread: 0.9 pips (Active trader), 1.6 pips (DD), 2.7 pips (NDD)

[icon name=icon-arrow-right] Maximum Leverage: 1:200

[icon name=icon-arrow-right] Money Withdrawal: 3-7 working days

[icon name=icon-arrow-right] Commissions: No* (Earning from the spread)

[icon name=icon-arrow-right] Payment options: Credit,Debit Card, Paper Check, ACH, Bank Wire

[icon name=icon-arrow-right] Withdrawal options: Credit,Debit Card, Paper Check, Bank Wire

[icon name=icon-arrow-right] Contacts: Toll free: +1 888 50 FOREX (36739), +1 212 897 7660, [email protected]

* Fees may apply for holding positions overnight and over-weekend

[icon name=icon-thumbs-up] Pros

[icon name=icon-plus-sign] Choice between No Dealing Desk and Dealing Desk Account types

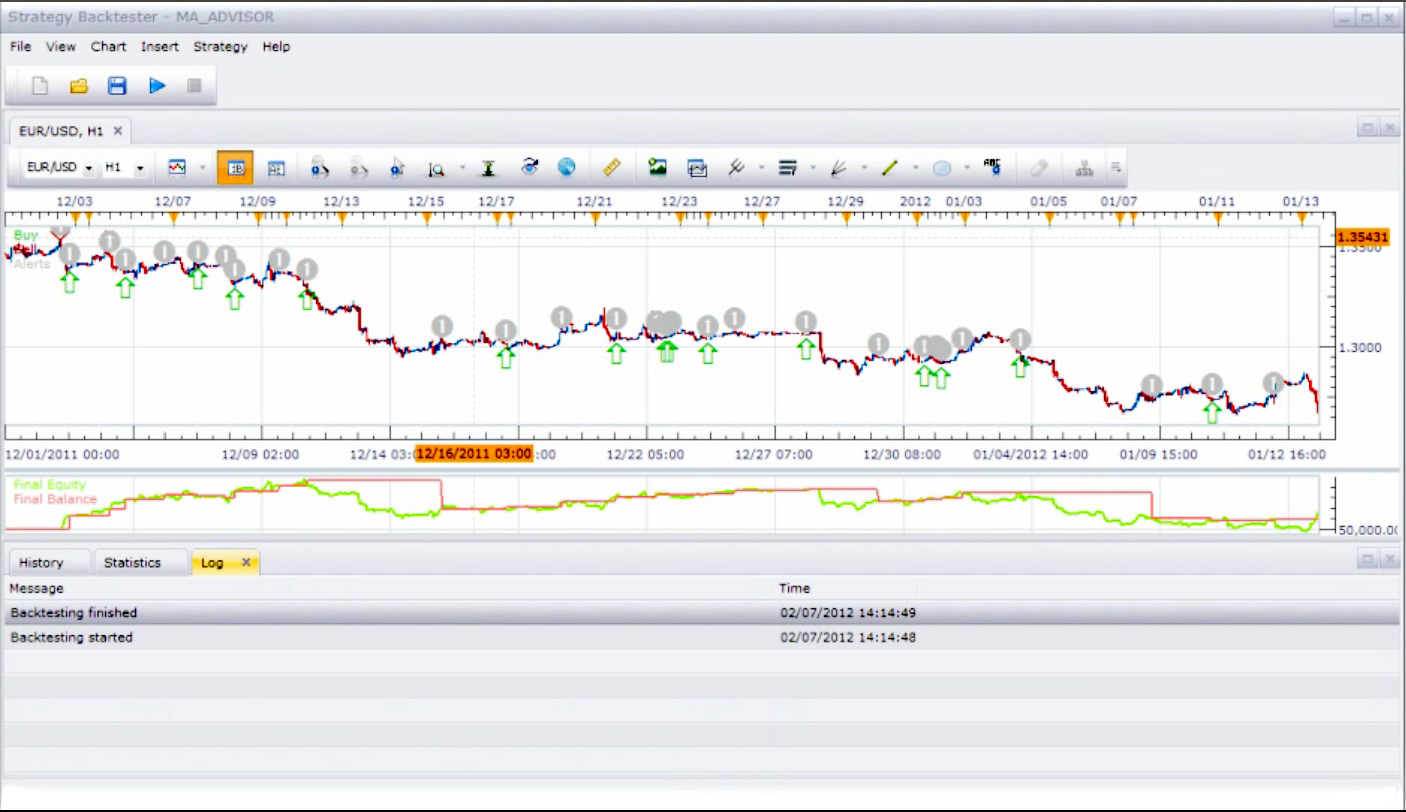

[icon name=icon-plus-sign] Robust and customisable desktop platform with professional charting tools

[icon name=icon-plus-sign] No re-quotes, no interventions and no delays of execution (NDD)

[icon name=icon-plus-sign] No trading conflicts between the trader and broker (NDD)

[icon name=icon-plus-sign] Anonymous order placement – stops, limits and entry’s are kept hidden. (NDD)

[icon name=icon-plus-sign] Scalping allowed. (NDD)

[icon name=icon-plus-sign] Possibility to trade the news without any delays. (NDD)

[icon name=icon-plus-sign] Strategy backtesting feature

[icon name=icon-plus-sign] Rich variety of platforms: from web, mobile to desktop and MT4

[icon name=icon-plus-sign] Exceptional Transparency

[icon name=icon-plus-sign] Accessible everywhere (web, ipad, iphone, android, etc.)

[icon name=icon-thumbs-down] Cons

[icon name=icon-minus-sign] No stock trading available.

[icon name=icon-minus-sign] The free DailyFx trading signals should not be taken as a holy grail, but just as viewpoints on the news impacting the market.