Identifying Buying Opportunity in USD/RUR amid Ukraine crisis.

Article Updated: October 26, 2014

Learn how to profit from the falling Russian ruble. A real case study showing the thinking process and analysis performed by a professional trader.

Samuel Rae is an experienced currency trader. He loves to trade exotic currency pairs. Sam came to know about the Ukraine crisis through media. Being a vigilant news trader, he soon realized that Russian Ruble might hit fresh all-time lows against the greenback in such a scenario. So he decided to buy USD/RUB on dips.

From Oct. 20. 2014 beginner traders have the access to trade with ruble with deposits from $50 on eToro platform.

Crimea Referendum

A referendum was due on March 16 in Crimea (a Ukrainian territory where almost 70% are Russian-speaking)—to decide whether the people want to join Russia or restore the 1992 constitution. After having an extensive research on the referendum, Sam found that an overwhelming majority of Crimea was likely to vote in favor of Russia. The western countries had already threatened that if Russia recognized Crimea, it would have to face strict sanctions, similar to what it had suffered in the cold-war era. So two things were clear from the news analysis:

- Crimea was expected to vote in favor of Russia

- Russia was expected to face sanctions from the western countries

It was very obvious that Russian currency and stock markets would react sharply on any sanctions from the west. So it was a strong indication that after the referendum the Russian ruble could hit new lows against the dollar.

Central Bank Intervention

It is generally observed that in a situation of crisis, the Russian Central Bank always intervenes into the open market to support its currency. So there was a possibility that the Russian bank might cap USD/RUR after the referendum. Thus, Sam decided not to open a buy position ahead of the referendum. He wanted to see the actual results of the referendum and then the reaction in the market.

Crimea Joins Russia, USD/RUR Tumbles

Things happened exactly as Sam expected. Crimea voted to join Russia and Russia promptly recognized Crimea. The western countries rejected the referendum and started imposing sanctions on Russia. To avoid the steep fall in ruble, Russian central bank intervened which consequently appreciated the Russian currency against the US Dollar. This was an ideal scenario for Sam because he knew that the bank could not be able to keep supporting the Russian Ruble for a long time especially when the US monetary policy was due on March 19. So Sam was ready to buy USD/RUB on dips.

Technical Analysis

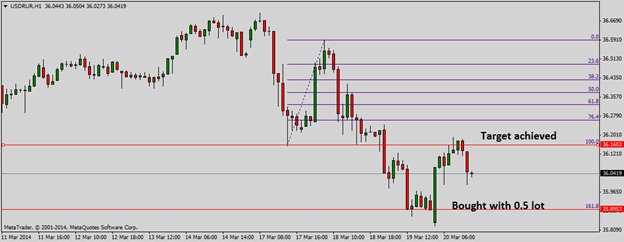

Traders were widely expecting another tapering (activities used by the central banks to improve the conditions for economic growth) on March 19 from the Federal Reserve of US after surprise jump in February non-farm payrolls. So Sam bought USD/RUB with 0.50 lot size at 35.90 which was the 161.8% fib level, he carried out the trade with 15 pips stop loss just ahead of the monetary policy decision from the Fed, his target was 36.15 i.e. 25 pips or $125 profit.

Profit in six hours

The Federal Reserve kept the interest rate unchanged and reduced the QE by $10 billion to $55 billion, as expected. USD/RUB shot up and within six-hour duration Sam collected the $125 profit. Sam’s patience and extensive research is a perfect role model for the beginner traders who often lose in the volatile market.

This is not a trading advice, but an illustrative example of forex trading process. And most importantly – we hope for peace and that the conflict stops as soon as possible.