Best ECN brokers

If you want super-fast millisecond order execution and want to trade $10,000+ then ECN might be for you. Otherwise, if you would like to start with smaller investments and friendlier user interfaces you might want to try social trading networks. Read on to uncover all the benefits and cons of ECN brokers.

What is ECN broker

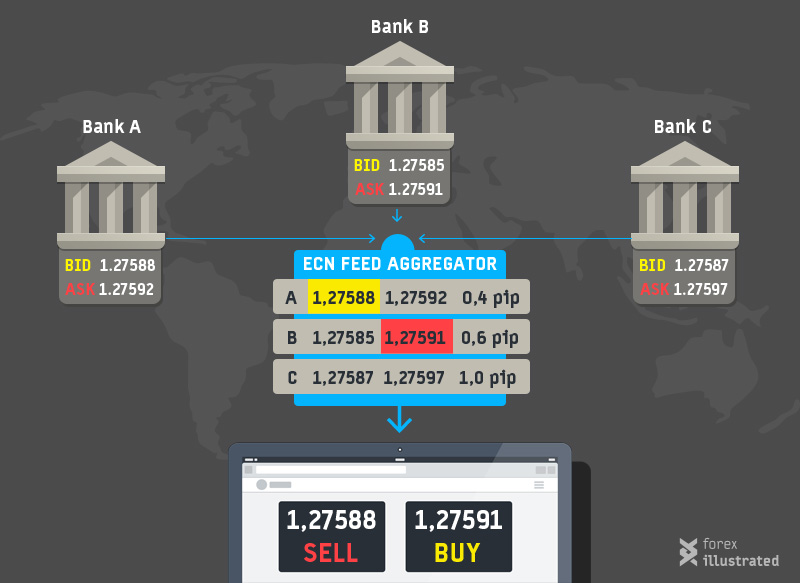

Abbreviation ECN stands for Electronic Communications Networks which is a technology used by forex brokers to connect their clients with the big participants of the foreign exchange market – Global banks, financial institutions, prime brokers and other instances known as liquidity providers. ECN brokers aggregate currency buy and sell prices from these liquidity providers choosing the best ones to be shown to all their clients. This model is comparatively very transparent and most ECN brokers don’t earn from the spreads but by charging fixed commissions based on the size of individual trades. ECN brokers are sometimes also called STP – Straight Through Processing.

How ECN works

ECN brokers provide their clients a direct and transparent access to the interbank market. Liquidity providers (Global Banks, Prime brokers, financial institutions, etc.) feed their prices to the ECN broker whose system automatically chooses the best prices offering the best spread available. Then depending on each individual broker’s business model these prices are either shown directly to their clients (if broker earns through trade amount commissions) or a small markup is added to the spread (usually ~ 1 pip). When the client decides to place an order it is sent through the brokers system (called bridge) straight to the liquidity provider who was offering the best price. These orders are sent anonymously so information about the trader, his Stops and order limits can’t be seen by the executing party. Rate provider then sends the confirmation back in a matter of milliseconds.

Benefits of ECN Brokers:

- Fastest order executions

- No conflict of interest: broker not trading against you

- No interventions and execution delays

- Transparency – market driven spreads

- Higher liquidity

- Scalping, news trading and hedging possible

- Trades are placed anonymously

- No disconnects during news events

Disadvantages of ECN Brokers:

- More money needed to start trading

- Platforms & user interfaces can be complicated and unfriendly for beginners

- Spreads can be higher as they are influenced by the market

- Higher cost of trading (but not always, see example 1)

- No micro accounts (unless the broker is a bank)

- Smaller leverages

- No guarantees for stop loss execution

- Execution prices also not guaranteed as the real market can move in split seconds

ECN brokers do not provide high leverages like market makers do. ECN’s normally offer leverages up to 1:100 as they are placing orders in a true interbank market, not a separate liquidity pool as market makers do. That’s why the minimum deposit is $1000 – to be able to trade one lot. ECN brokers also don’t have micro accounts. What they can do is allowing traders to trade with fractional lot sizes – one tenth of a lot or 1 dollar for a pip.

Recently there has been a significant increase of interest towards ECN brokers as retail brokers are undergoing reputation problems due to several unscrupulous retail brokers. This interest has created a situation when it is quite hard to find true ECN brokers as many retail brokers are falsely pretending to be ECN brokers. Here are the main tips how to spot real ECN brokers among fake ones:

Characteristics of real ECN brokers:

- Charges Commissions

- Variable spreads

- Leverage not higher than ~1:50

- High deposit requirements

- No partial lot options

- Electronic bridge is used connecting the platform with multiple liquidity providers

- Scalping and news trading allowed – you can place stops close to the price

One must take in mind that a broker can act both as an ECN and retail broker – for example FXCM. Such double model allows the broker to serve both big and small volume traders. If the client makes big transactions of several thousand USD then he is granted access to the inter-bank market, but if client’s positions are small he can use the retail market model which is more suited for traders with lower investments and less experience.

ECN is not a fairy tale

Many people have a misconception about the real interbank market. After failing to succeed with a retail broker they hear the stories about how transparent and fair are the ECN brokers so they rush to them only to find out that it is not so easy also on this side. In fact it can be even harder in the real inter-bank zone as the broker is not intervening or protecting anyone so traders are one on one with the harsh exchange market. The prices can move drastically, especially during news events, that’s why ECN’s can’t and don’t guarantee exact executions of the ordered prices or stops – what you get is not always the price you saw on the screen, but the actual market price which can move 5 pips during the time you pushed the button and the transaction went to the liquidity provider. Also there are no negative balance guarantees in ECN model, like in the retail broker’s model where you can’t lose more than you deposited. But such is the environment where big traders operate – unemotional and risky, but it is the real deal for those who seek the opportunity to make big profits.

To sum up

ECN brokers are great for traders who have large free resources to be traded and who have the experience to handle the advanced platforms and systems. If you don’t want to invest thousands in the start but prefer deposits of $100 to $200 then retail brokerages or social trading networks could be more suitable for you.