This is the ultimate guide to the best trading platforms and tools for forex and stock trading in 2022.

I recently analyzed the tools used by 184 successful traders to answer the question:

What are the best software tools that professional traders use, and are they worth the money for beginner traders?

And let me be clear about something:

This is NOT your average “Best Trading Platforms” post trying to make money from affiliate links.

Yes, there are a lot of paid tools on this list.

But there are no affiliate links. Just the best tools are selected based on their added value. And you’re also going to see tips and fresh strategies for saving money with FREE tools and some clever workarounds.

So if you want to improve your trading, you’ll enjoy this new guide.

For those in a hurry, here are our favorites from all these Trading Software tools:

- Best trading workstation: Money.net – $175/mo

- Best trading journal: EdgeWonk – $187 once

- Best Up-to-second Trading News source: LiveSquawk – £250.00/mo

- Best Economic Calendar: FXStreet calendar – $0.00

- Best Forex Trading Market Hours tool: MarketHours.net – $0.00

- Best Trading strategy backtesting tool: Replay on TradingView – from $14.95/mo

- Best Currency Correlation Tool: Mataf correlation dashboard – $.00

- Best Pip calculator: FXPRO pip calculator – $0.00

- Best Position size calculator: MyFXBook – $0.00

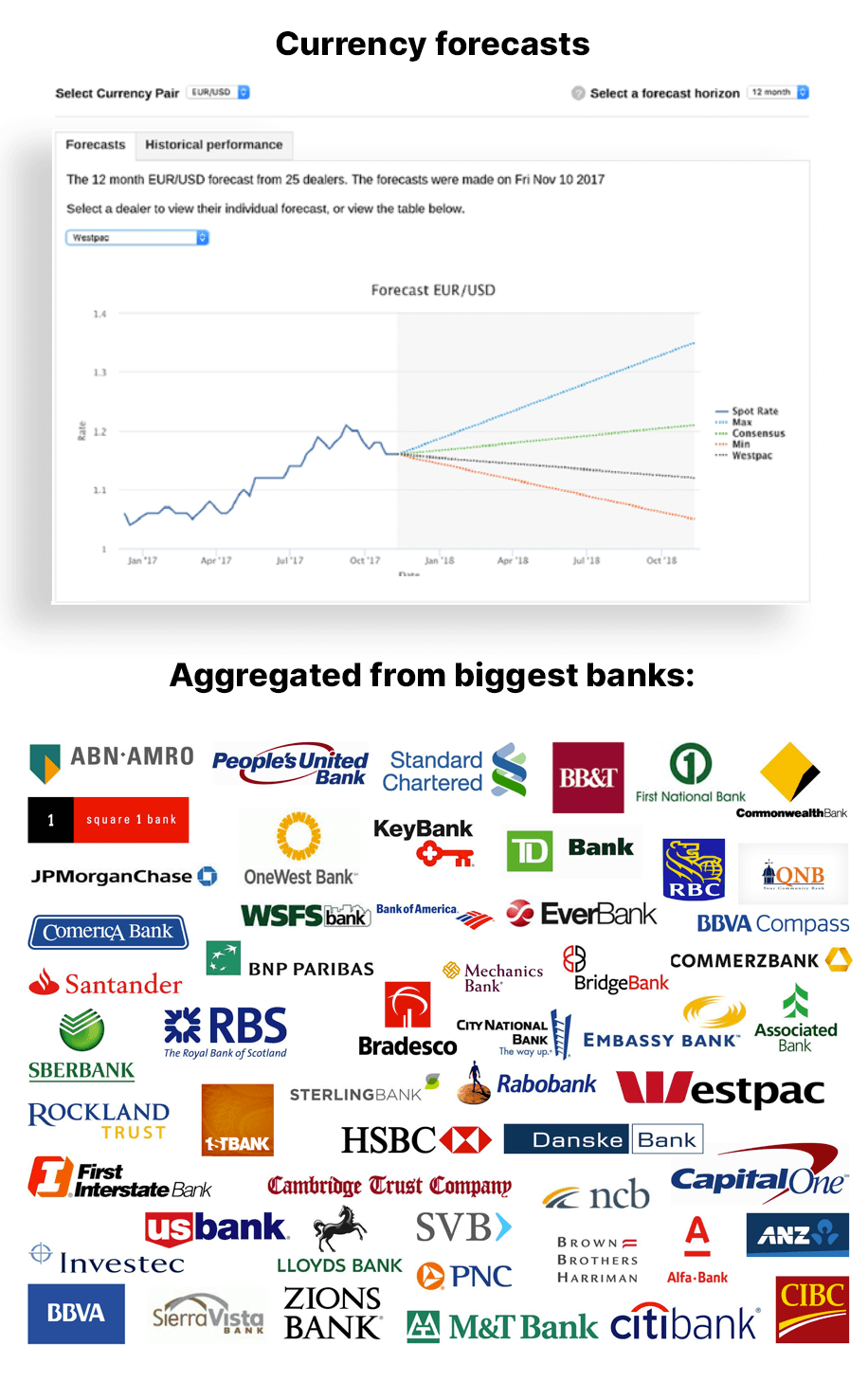

- Best Currency Forecasts: FXStreet forecast tool – $0.00

Read on to uncover the full list and insider info about all the trading software categories. Your favorites might be different!

1) Workstations (Data & Charting)

➡️ Bloomberg Terminal $24,000/year (Yes, it’s crazy!)

➡️ Refinitiv Eikon (By Reuters) $22,000/year (Also crazy)

➡️ Money.net $175/mo

➡️ ProRealTime $35/mo – $280/mo

➡️ Metatrader4 $0/mo

➡️ TradingView $0 – $59/mo

The most expensive platforms (Which are most probably not for you)

The cutting-edge terminals for hardcore finance geeks who use seven computer screens are Bloomberg Terminal and Refinitive Eikon. They are the Matrix of trading.

However, when can be very overwhelming for average person.

Their interfaces? They look clunky and old-school ⬇️

Here comes the But – they’re functional as hell and offer everything from technical indicators, breaking news, and in-depth research to lightning-fast trade execution.

Additionally, Bloomberg even gives its subscribers their iconic colored keyboard!

I think they should also include a Herman Miller chair and office space for this price. Think about it, Mike!

Talking about Mike – do you want to know how much ? Mike Bloomberg makes with their terminal? Given that they have 325,000 users, they make $7 Billion – $8 Billion per year. Not too shabby, right? No wonder Mike’s net worth is $60.1 Billion.

Do you – an aspiring trader – need one of these cutting-edge beasts?

I don’t think so. Unless you make ~$100k/mo from trading and enjoy getting paralyzed by info overload.

Bloomberg’s terminal is the most expensive among financial data providers. It costs $24,000 a year for a single terminal subscription. Also, it’s more geared towards prominent portfolio managers, way above the pay grade of average retail traders. You can get more than enough functionality for much less money by combining the other tools on our list.

? Want to know the secret of why Bloomberg keeps dominating the terminal market for so long? It’s because the whole of Wall Street communicates via Bloomberg! And if you move to another system, you lose access to Bloomberg chat rooms. And they are full not only of gossip but also useful insider insights. That’s why Bloomberg has such dominance over the market.

Here come the affordable solutions

First of all – your broker’s terminal might be sufficient for your needs!

If it’s not, and you want inexpensive but functional charting, trading ideas, and chat in one place – you can check out TradingView, which has become super popular in recent years.

Busted: Many big retail brokers use TradingView charting solutions as plugins for their “proprietary” platforms. It’s an indicator that TradingView is up to scratch.

Looking for something similar to the Bloomberg terminal, where everything is in one place but for a more affordable price? Check out Money.net or ProRealTime. The financial information on these two tools allows anyone to have similar market access as a Wall Street trader or analyst.

We found a valuable insider you might like: It’s worth noting that Money.net is made by Morgan Downey, a gentleman who was the former global head of commodities at Bloomberg. So he knows what should be inside a great workstation.

Are you just looking to impress your followers on Instagram?

If you want to impress people – have the Metatrader4 open on a couple of monitors. Everyone will think you’re the wolf of Wall Street ;). Metatrader is also handy if you want to use and execute automated trading signals (EAs) from different providers. MT4 offers a lot of customization, and many traders code their own custom programs for it.

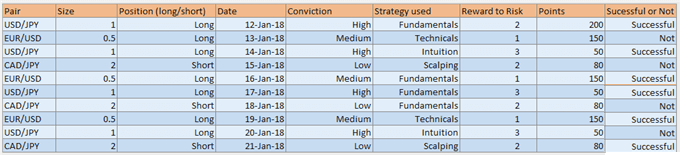

2) Trading journal

➡️ EdgeWonk – $187 One-time payment. Our favorite and the most popular and functional one. The downside, and it’s a big downside, is that Edgewonk is not cloud-based and requires installation. So there’s no mobility. It’s still great, though.

➡️ TraderSync – $0.00/mo – $79.95/mo. The upcoming stylish one. It has mobile apps as well. It needs some more time to reach the level of EdgeWonk.

➡️ TradeTracka – $39 One-time payment. Advanced spreadsheet templates for Microsoft Excel or Numbers.

Dear Diary,

Today I forgot that the FED’s announcement was due, and my EUR/USD trade got wiped out because of the volatility spike, and I lost $2,468. I guess I should have used a trading journal?

You can’t improve what you don’t measure

It’s hard to find a decent trader who doesn’t journal his trades. It helps you identify your mistakes and develop strategies for finding the biggest winners. It also enables you to understand what type of trader you are.

In the beginning, you can use a simple Google sheet as your trading journal or use the cheaper TradeTracka templates with built-in calculations and filters.

? Pro tip: Besides journaling the dry numbers, giving context to your trades is beneficial. Here’s an example:

April 21. Today’s target is $2,000 and only act according to my strategy!

-

EUR/USD, 9:35, Missed a setup, should have been more aggressive.

-

AUD/USD, 10:48, I saw an opportunity to sell at 0.5 Fibonacci level for a few minutes. I waited until 3 five minute candles closed bearish. Profit: +$230. I could have banked more profit, but I am happy.

-

USD/NZD, 12:34. Based on the FED announcements, the USD will probably continue rising. So I’m going to try to get a quick scalp and buy it for a few minutes of a major support area. Profit: +$140.

Once you start making consistent profits, you can consider moving from simple spreadsheets to EdgeWonk or TradeSync.

These two are not just for note-taking and fancy visualizations. They use algorithms to tell you how to set better stops to avoid stop-hunting. Also, they make suggestions on where and how to put your targets to increase your winners’ size. And they can sometimes even pinpoint the weak habits that you keep repeating and losing money.

? Another free hack: TradingView lets you publish your ideas. When you mark them as “private,” no one else can see them. This approach is helpful because it automatically attaches a screenshot of what you’re looking at when writing the idea. Later you can use the replay functionality to see what happened.

3) News sources

➡️ LiveSquawk – £250.00/mo. Up-to-the-second audio commentary on breaking financial headlines, price levels, and data announcements.

➡️ NewsSquawk – £150/mo. Similar to LiveSquawk, but with a dedicated forex channel, making it cheaper.

Not everyone likes the news

I like being in the loop about fundamental factors behind the price action. But other traders, who use purely technical analysis, avoid the news. It depends on your strategy, if you’re a fundamental or technical trader, and on the time frame.

If you want to be a successful trader who doesn’t focus only on technical analysis, it’s often great to get the financial news ahead of the traditional media outlets.

How to gain an edge over other traders

You need to get the breaking news before the journalist spends two hours writing the article, getting approval, and waiting for the proofreader.

When the news about the FED’s decision to cut interest rates is published in Financial Times – it’s often already too late. The competitive edge for maximum potential profit is gone.

Besides the bare facts, successful long-term traders need to understand WHY the events happened. That’s why pro traders are using tools like Bloomberg Intelligence and services called Squawks for more in-depth insights. In an age of automated trading and Robo-advisors, insight is your edge.

Squawk, step into our office

A squawk is a 24/7 audio feed made by a finance team scanning the news for you and giving their insights.

Traders listen to these while they’re trading, so they don’t have to waste time searching and reading.

One of the cool aspects of squawks is that you sometimes might get valuable insider info.

Let’s say a trader at a bank has a friend who heard that the Swiss National Bank (SNB) was going to lift a currency peg today. That trader tells his colleague, who passes it to a squawk employee, who feeds it through the squawk. And ka-ching! You can make some money. And the worker at the SNB who first passed the info gets some jail time. ?

4) Economic calendar

➡️ ForexFactory economic calendar – $0.00/mo – One of the most popular calendars. But I wouldn’t say I like it very much, to be honest.

➡️ Trading Economics calendar – $0.00/mo – This one is better because you can comfortably sort the events by country and economic impact if desired. And you can also set your time zone so that the event times are in your local time.

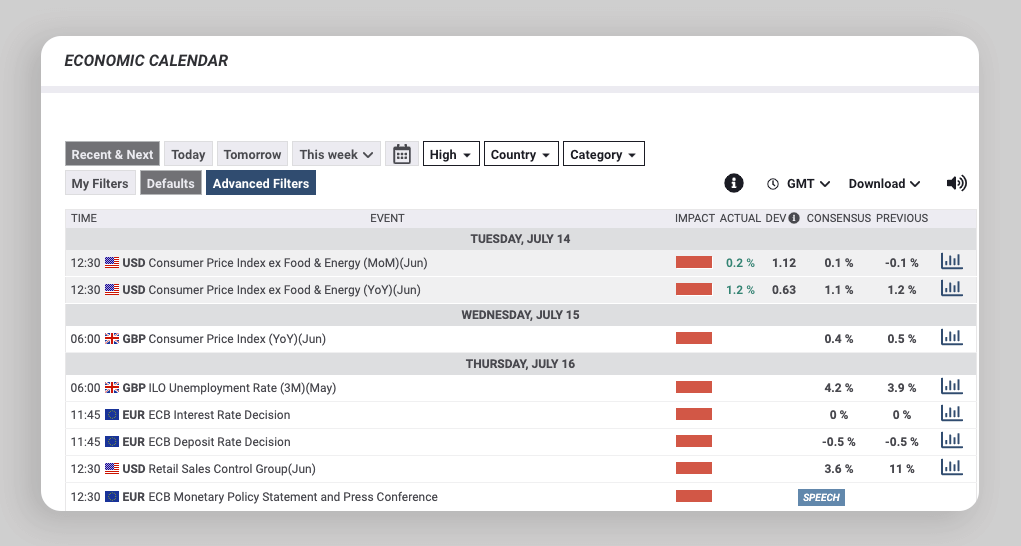

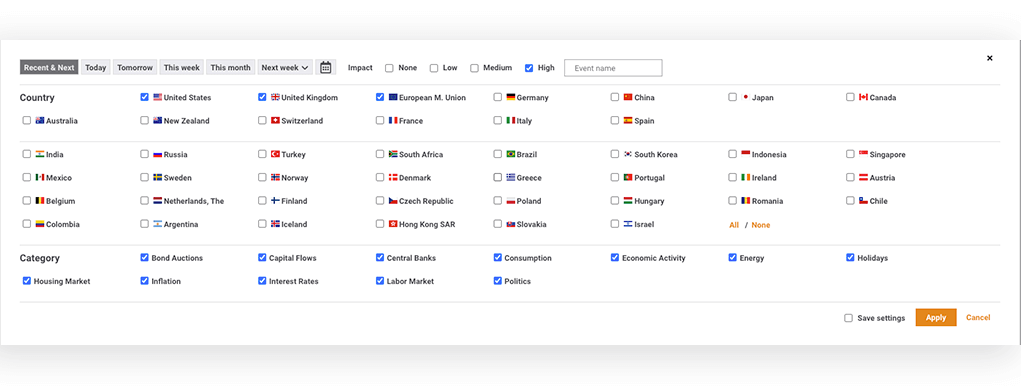

➡️ FXStreet calendar – $0.00/mo – This one has even more detailed filtering under the “Advanced filters” tab. You can also filter by categories like Politics, Interest rates, the Housing market, etc. The only downside to this calendar is that there are loads of ads on the site, but you can avoid them by using an adblocker like uBlock 😉

The top calendars are quite similar. The main difference between them, besides design, lies in the filtering options. Another difference is how they determine which events are “high impact” and “medium impact.”

For example, some events in the FXStreet calendar are marked as “high impact,” while the same events are “low impact” in the ForexFactory calendar.

How to filter out the stuff that’s not relevant?

If you don’t filter out the events, you might get overwhelmed and paralyzed with all the data. Here’s an example of how I use the FXStreet calendar to remove most of the noise.

I usually leave just three geographies: the USA, EU, and the U.K. Of course, it depends on the currencies you are trading, so when I would trade USA/AUD, I would also have Australian events turned on. And I leave all the categories on because your Impact filter choices will filter categories as well.

Then in terms of impact, I only leave the High impact events. And voilā – you now have a manageable list of news events without the irrelevant noise!

5) Market hours & volatility & volume (+ Time zone converter)

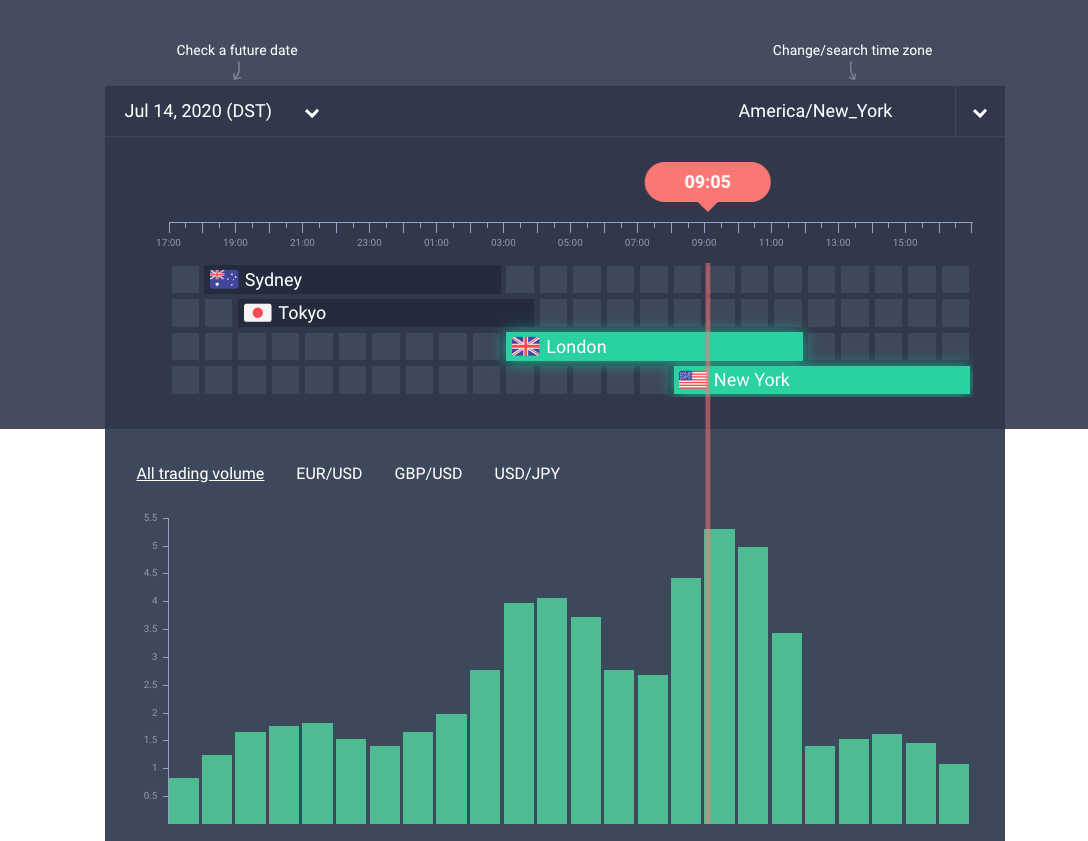

➡️ MarketHours Tool – $0.00. This is the most functional market timing tool out there.

What’s so good about this particular market timer? Glad you asked:

- You can avoid losses by seeing when the volatility is the lowest for different currency pairs.

- Pinpoint the risky “Witching Hour” and read about it in the “The Worst 3 Times to Trade Forex” section on the MarketHours site.

- Besides the opening and closing times, you can also see the most profitable times by looking at the historical averages of trading volumes for the most popular currency pairs.

- You can always see what’s happening at the major trading desks.

- Unlike other tools, it considers the different bank holidays in each country.

The final kicker? I built this tool with my team because I was frustrated that all the other market hours tools were outdated and just $hitty. Check it out while it’s still free to use!

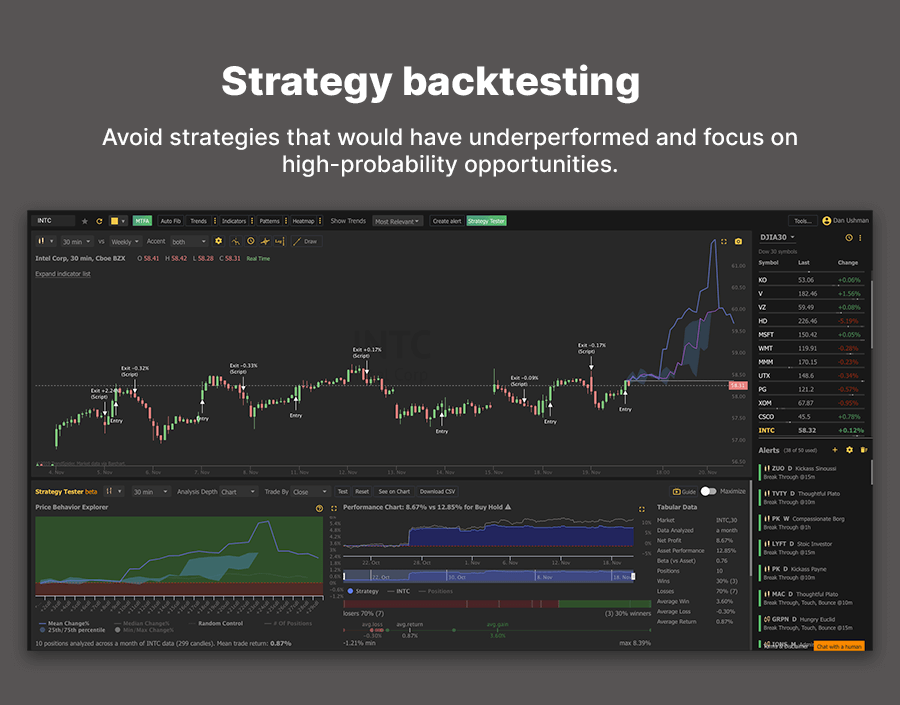

6) Strategy back-testing

➡️ Replay on TradingView – from $14.95/mo – super simple and affordable.

➡️ ForexTester – $149 on time

➡️ FX Blue Trading Simulator v3 for MT4 – $0

➡️ TrendSpider – $57/mo

Modern back-testing tools allow you to test manual or automated strategies by running them against historical data.

The best part is that, unlike demo trading, you can find a trading pattern or setup that you would like to test and then fast-forward the time so that you don’t have to wait.

? Pro Tip: If you trade and do your analysis manually, put the work in, and back-test them manually as well. This way, you can train your subconscious to spot setups by glancing over charts and patterns.

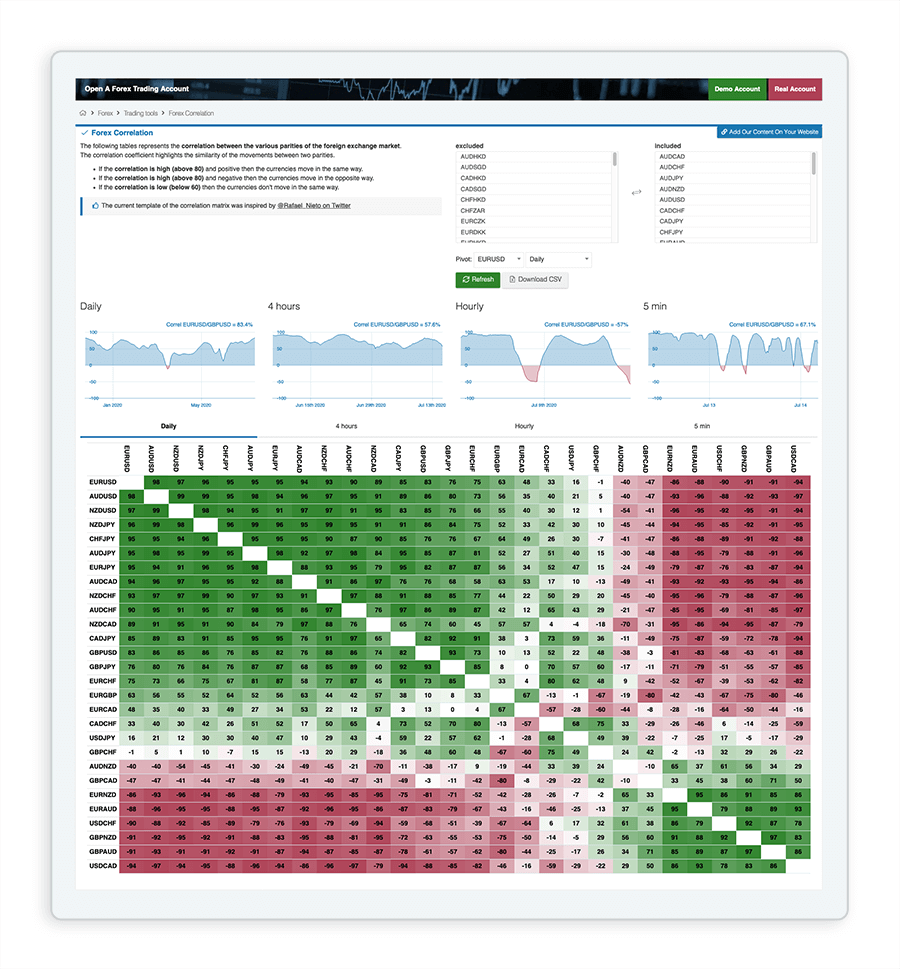

7) Currency Correlation Tool

➡️ Mataf correlation dashboard – $0.00. One of the juiciest correlation tools. It offers an excellent overview of currency correlations, including different timeframes.

⚠️ You’ve been warned: If you’re trading several pairs simultaneously and don’t know the currency correlations, you will eventually get WIPED OUT!

For example, if you have bought multiple currency pairs with a strong positive correlation, you will be exposed to higher directional risk.

Also, without checking the correlations, you could open positions that effectively cancel each other out.

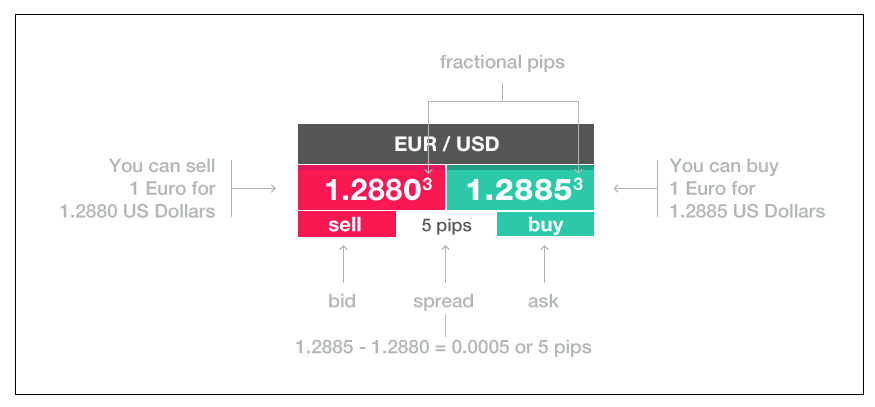

8) Pip calculator

➡️ FXPRO pip calculator – $0.00. A clean, modern, and easy-to-use calculator. Unlike most others, it works nicely on mobile devices as well.

So you have made +15 pips by trading EUR/JPY. Ok, but how much is that in U.S. dollars?

A pip value calculator will help you calculate the value of a pip in the currency you want to trade in.

When trading currencies, a “pip” is the smallest unit of movement.

Traders carefully observe these movements since trades are usually done in large volumes, where each small price movement could lead to significant profit or loss.

Summing it up: Pip value is crucial in determining if a trade is worth the risk and appropriately managing the risk.

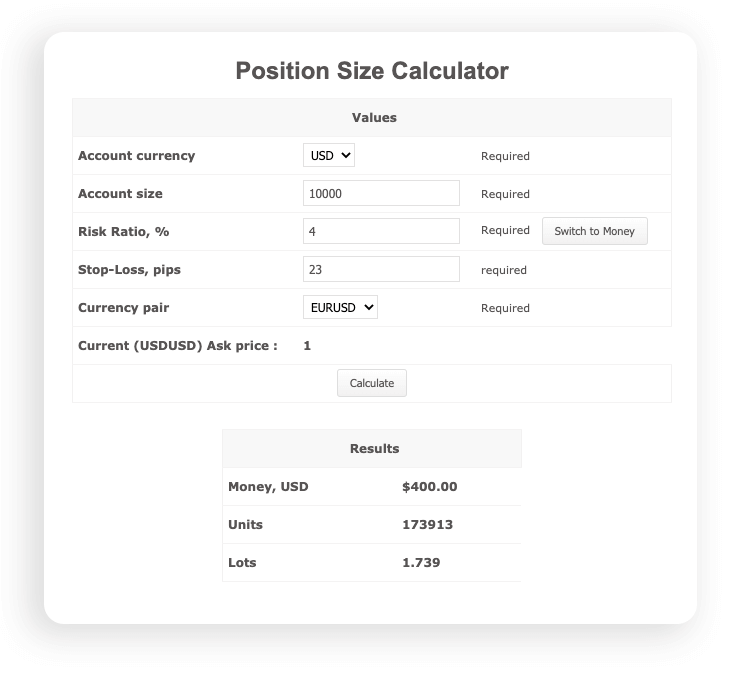

9) Position size calculator

➡️ MyFXBook – $0.00. There is no rocket science behind position calculators, so most should do. But this one has a handy switch between risk and investment.

One of the essential aspects of trading is risk management.

Correct position sizing is crucial to managing risk and avoiding losing all your money in a few trades.

Bottom line: A position size calculator helps to find the approximate amount of currency units to buy or sell to manage the maximum risk per position.

10) Forecasts from top analysts

A. Short-term sentiment forecast (1week, 1mo, 3mo)

➡️ FXStreet forecast tool – $0.00 – Great insights combining the price forecasts from leading market experts.

The FXStreet forecaster is a helpful tool I use together with technical and fundamental analysis.

Simplified example use-case: When the sentiment is not at extremes, traders often use it to get actionable price target ideas. When there is a divergence between the actual market rate and the forecasted rate, there is usually an opportunity to enter the market.

B. Long term forecasts (1mo, 3mo, 6mo, 12mo, 24mo)

➡️ FX-markets.com Currency Forecast Tool £2,395/year

➡️ FX4casts.com $995/year

These two tools offer forecasts for major currencies based on input from currency strategists in 50 biggest banks, such as Goldman Sachs, Deutsche Bank, Credit Suisse, Commerzbank, Citigroup, etc.

They are used mostly by those financial officers with blue suits who manage the currency risks at big global companies. They provide them with insightful currency market analysis to better time the foreign currency transactions to help control the currency costs.

I don’t wear a blue suit, but I use the forecast service. How and why? I find them very useful for learning the inside tricks of currency markets. The currency strategists from the big banks often reveal some golden nuggets of their thought processes in the reports.

How you can save a ton of money: these long-term forecasts are super expensive. The shorter-term forecasts will be more than enough in terms of predictions.

? If you want to get the condensed golden nuggets from top analysts that I have filtered out – you don’t have to spend £2,395. Instead, you can download the free learning app Forex Hero, where I have compiled a lot of great insights from the leading currency analysts.

(BONUS) Gandalf & Sax music

To finish on a fun note – turn on the sound and watch this cool trading workstation setup:

If you have 7 screens for your trading setup, it would be silly not to try this! Here’s a 10-hour-long HD version of the video. You’re welcome ?

The only question is, how do you divide 7 monitors in a divorce? Here’s how it usually happens to the traders: They keep all 7, and the wife gets the house and car.

?? If you liked this post, it would be great if you shared it – that helps us a lot!