We have gathered systematic guidelines for reading and understanding the currency rates and pairs giving illustrated explanations for better understanding and memorizing.

Read this article if you want to learn which currency pairs are best for beginners.

As you might already know currencies are traded in pairs. The first currency of the pair is called the „base currency” and the second is called „quote”. To prevent confusion the order of the currencies in the pairs are fixed, for example EUR/USD quote is always in this order and not USD/EUR. This is regulated by the ISO (International Organization of Standardization) which controls the order and the codes of currencies.

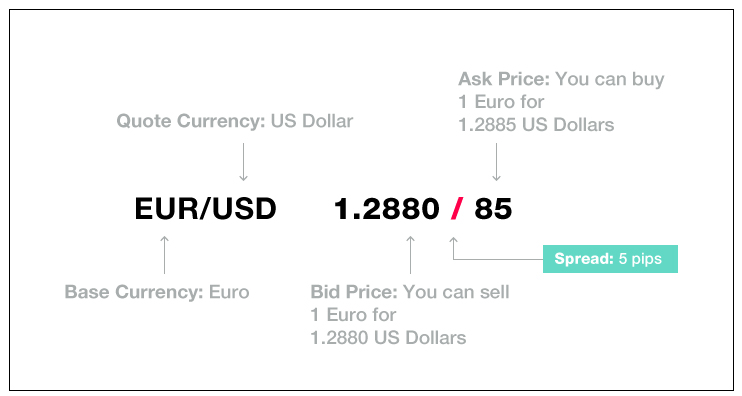

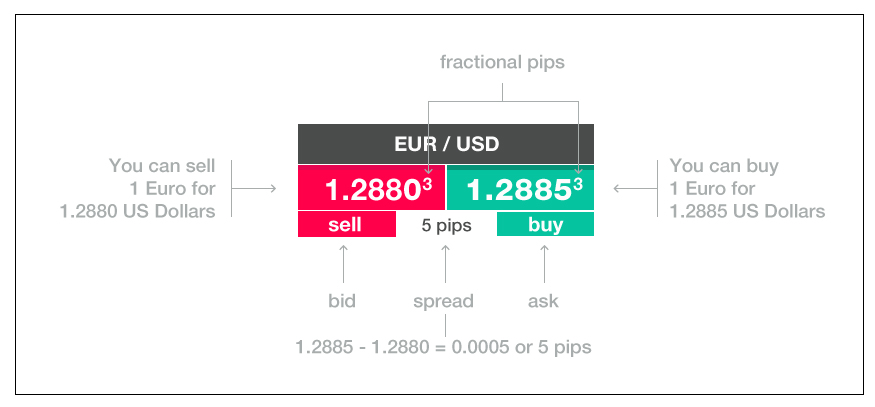

In figures 1 & 2 you can see two different ways how currency rates (quotes) are can be displayed by foreign exchange brokers:

The most popular option how currency rates are displayed is in a line – this is a simplified type used to save display space when multiple rates have to be shown.

Other option are block displays which are often used in the trading platforms as they are easy to read and the bid and ask blocks can act as buttons for performing the buying or selling actions. Still people often confuse the meaning of “sell” displayed with the bid price. “Sell” doesn’t mean that the broker sells at this price, but instead that YOU can buy the base currency at the specific amount of quote currency.

Currency rates are represented with a price that shows bid and ask prices – EUR/USD: 1.2880/1.2885 where the price before slash is the Bid that is the selling price and Ask (after the slash) is the buying price which is always higher than bid. The difference between bid and ask prices is called the spread – this is the commission that you have to pay to enter a position. Spread is expressed in pips (a pip – the fourth number after the decimal point). In EUR/USD: 1.2880/1.2885 the spread is 5 (85-80).

Some platforms/brokers also show fractional pips (also known as “pipettes”) – a fifth decimal place. This is handy when extra precision is needed for big deals.

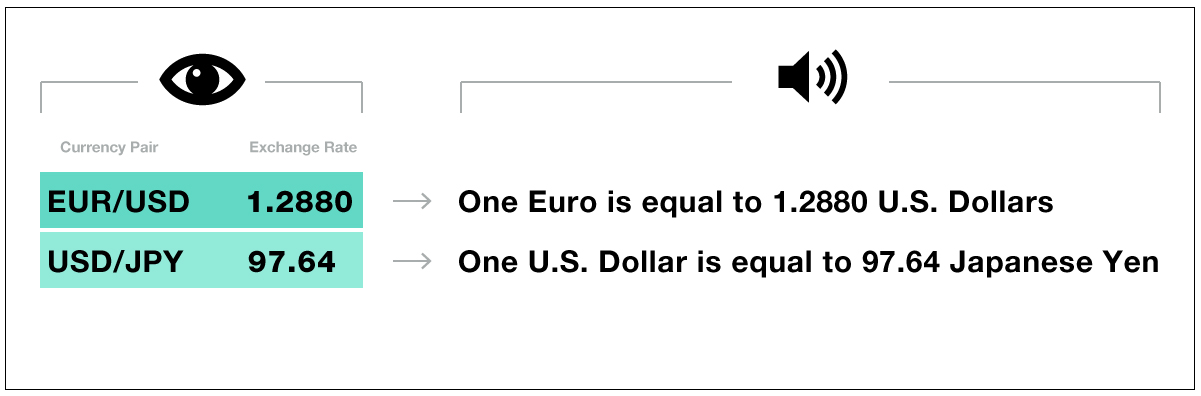

Trick Nr.1. How to read the exchange rates

Currency rates seem easy until someone asks you to read them out explaining what exactly the rate number represents. A nice system to help remembering how to read the rates is to think of the base currency as Number One – for example if the rate for Euro Vs U.S. dollar is EUR/USD 1.2880 you read the rate like this: one Euro is equal to 1.2880 dollars. Likewise if the USD/JPY has a rate of 97.64 it means that one U.S. Dollar is equal to 97.64 Japanese yen.

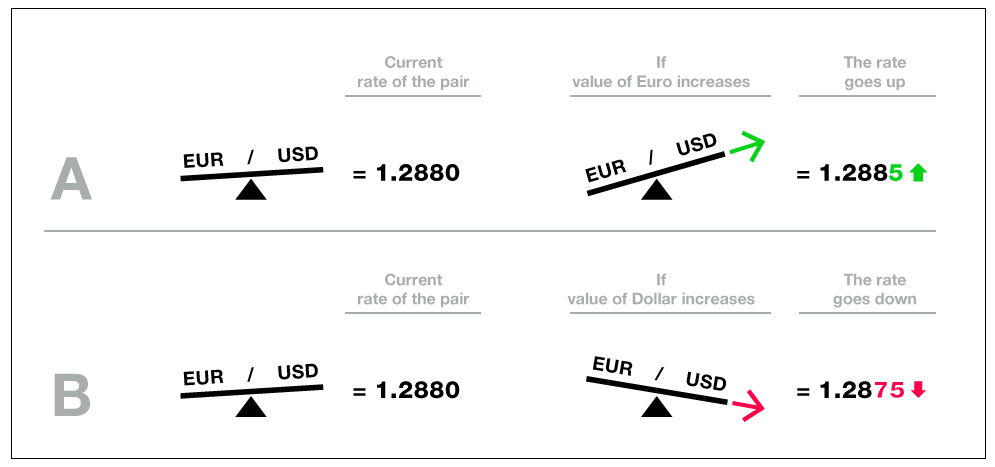

Trick Nr.2. Understanding the changes in rates

It is crucial to understand what happens with the currencies when the rate changes up or down – which of the currencies has become more valuable in comparison with the other and vice versa. In order to help understand it better and remember how it works we implement a “mind system” of a lever with an arrow.

Think of both currencies as if they are placed on a scale/lever. (See Fig. 4.)

A: If the base currency (EUR in our case) becomes more valuable than the quote currency (U.S. Dollar) – the lever tilts pointing the arrow upwards – this means that the rate is also going to increase (meaning that you can get more Dollars from one Euro than before)

B: If in turn the Dollar becomes stronger relatively to the Euro then it tilts the lever down to its side pointing the arrow down which indicates that the rate is also going down.

Types of currency pairs

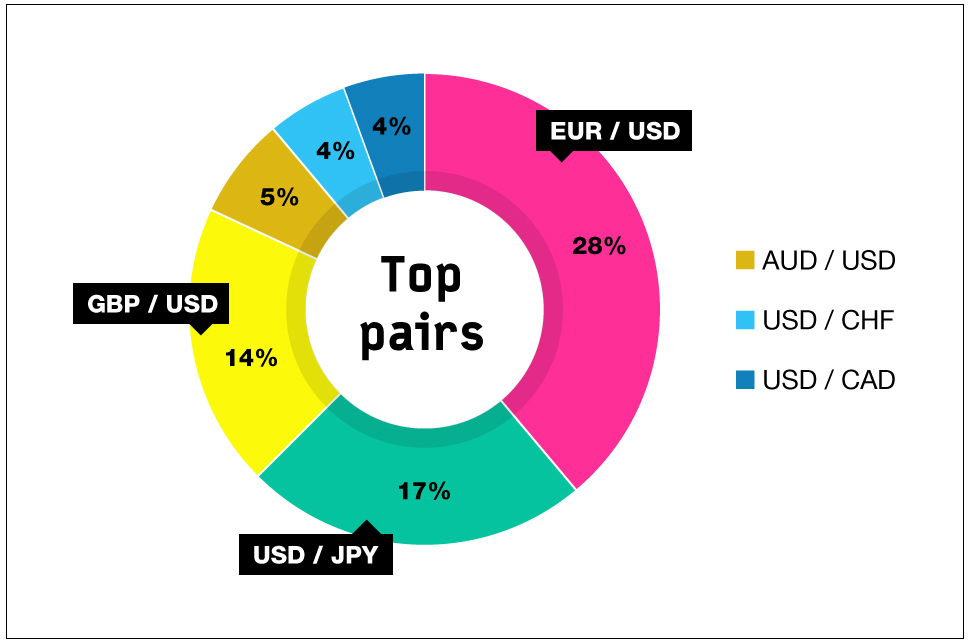

There are three types of pairs: majors, crosses, exotics and commodity currencies. As you can see in the chart the most popular pairs include U.S. dollars and these pairs are called Majors.

Majors

The most important rule of the Major pairs that you have to bear in mind is that they often tend to have similar movement trends as they are all associated with the U.S. Dollar, so trading several majors in the same time is quite risky and in order to diversify your portfolio you should be mixing major pairs with others.

Advantage of the majors: they usually have smaller spreads (commissions) that other pairs.

Crosses

Crosses are pairs that do NOT have U.S. Dollars in them. Pairs that include EURO are called Euro crosses. The top crosses for trading are these four: AUD/JPY, GBP/JPY, EUR/JPY and NZD/JPY. They are a nice addition to any of the major pair for trading.

Exotics

Exotics are currency pairs that include currencies of emerging and developing countries from the Middle East, Asia and Africa such as Singapore, South Africa, Mexico, Turkey etc.

Drawbacks of exotics: they are the riskiest pairs as they have the lowest liquidity and the highest spreads (up to 10 pips compared to 1-3 pips for majors), which come with slippage problems and high costs of trades. That’s why exotics are not recommended for beginner traders.

Commodity currencies

Commodity currency is a name used for currencies of countries whose economy strongly depends on export of certain materials as gold, silver, oil etc. For example Canadian dollar is very dependant on the price of oil as Canada is a big exporter of it – when the price of energy rises also the Canadian dollar rises and you can then see a slip in the USD/CAD rate because U.S. dollar then falls compared to Canadian dollar as USA is a big importer of oil.

The problem with commodity currencies: especially with the USD/CAD can be hard to predict as it is very sensitive to news about other oil producing countries (Iraq, Iran etc.)