Snap Inc. – the company behind Snapchat – the successful messaging app for youngsters, is going public on March 1st, 2017. There is a lot of buzz around this event as it opens big possibilities of the stock price volatility.

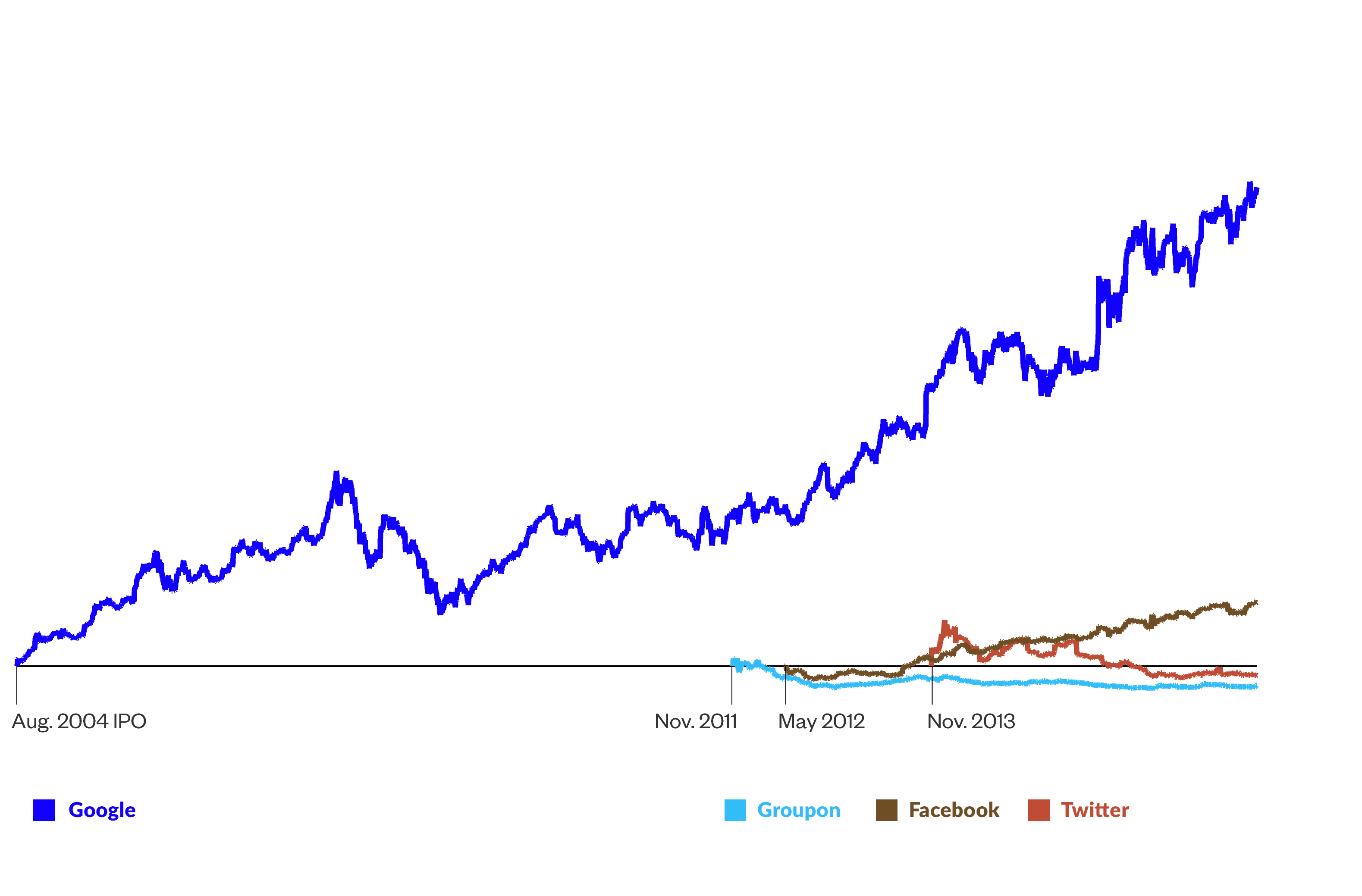

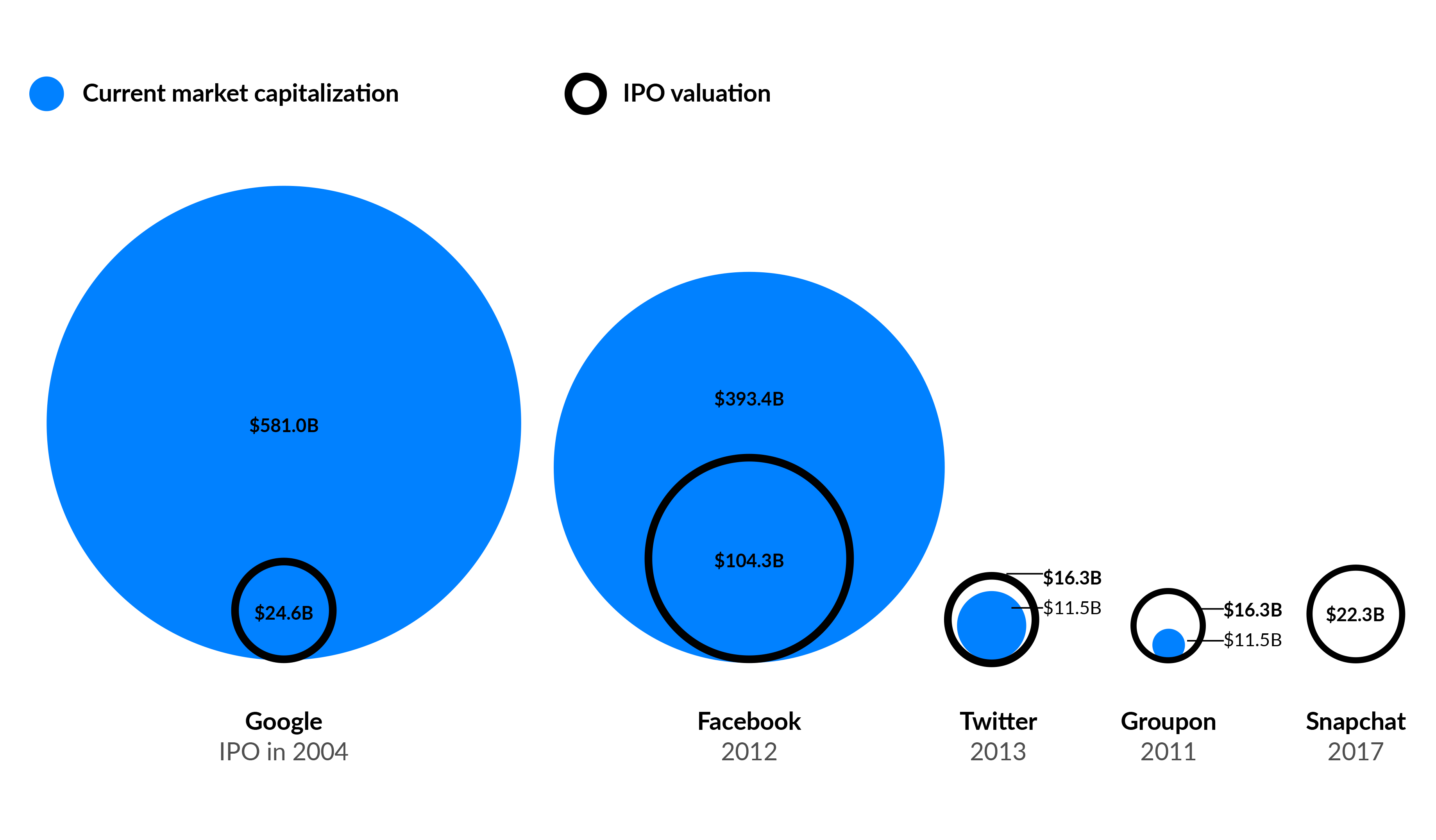

The big question is whether it will be possible to make money by investing in this stock. Nobody seems to know for sure as there are different examples that have went both ways. Facebook and Google went public with huge valuations and they soared after the IPOs. On the other side there are Twitter and Groupon that both lost money after their initial public offerings. See the charts for more detailed info:

Here is how the share prices moved after the IPOs:

Arguments AGAINST investing (going Short)

- Snap is not profitable. They are generating revenue, but still losing money.

- Nearly ½ of the 200 tech companies that had IPOs since 2010 are now trading below the price at which they sold their IPO shares.

- Snap Inc. has been in business for a short time (2 years).

Two people below the age of 30 run it.

Arguments FOR investing (Going long)

- The average revenue Snapchat generates from each daily user more than tripled in the fourth quarter of 2016.

- If Snapchat can grow to Facebook’s average revenue per user, it is estimated that it would translate into an extra $5,5 billion in annual sales, even if Snapchat’s audience size stays the same size.

- Snapchat’s advertising revenue has grown very quickly. If it keeps similar growth rate, it could generate billions of dollars in additional revenue.

- More than 75% of Americans from 18 to 24 who have smartphones use Snapchat at least once per month.

What do you think about Snapchats’ IPO? Will you invest or will you go short?