This is an exclusive article for Forex Illustrated by Elite Popular Investor Kenneth Mowat, a.k.a. Simple-Stock-Mkt.

Hello traders! Deciding which traders to copy sounds easy, but it is a tricky process with so many different traders and trading styles to choose from. It can be quite daunting to someone unsure about what they are doing. I thought I would put a few tips together as a recommendation of what I personally might look for in a search for the best traders to copy.

Let’s start on the trader’s Stats page.

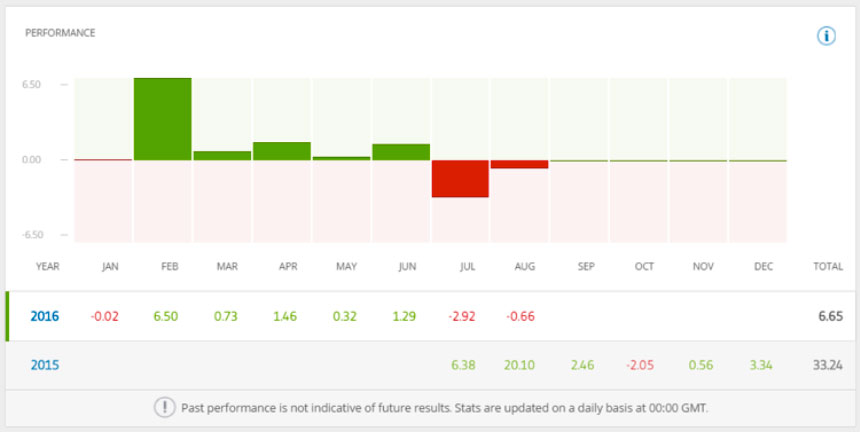

1. Look for consistent profits over 1 year or more.

The first thing to look for is what we are all interested in profits! Has the trader been consistently profitable over a reasonable period of time?

Of course, it is perfectly possible that someone could have seen huge profits over a short period of time, but unfortunately, this does not necessarily mean that they will be able to continue to be profitable in the medium to long term.

Although a trader may be convinced that they have a great system, it could just be that they have been lucky and caught a nice trend in a particular market. So a few good months does not necessarily mean that a trader has a good system. Will their system still be able to make positive results once the current trend has stalled or reversed and higher volatility has come back into the market?

I have seen many people diving into copy traders with some big short-term gains only to find they have copied at exactly the wrong time. It is advisable to only consider those traders with enough history to demonstrate consistent profitability over a reasonable period of time, preferably in a range of markets.

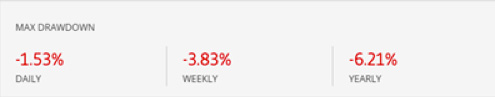

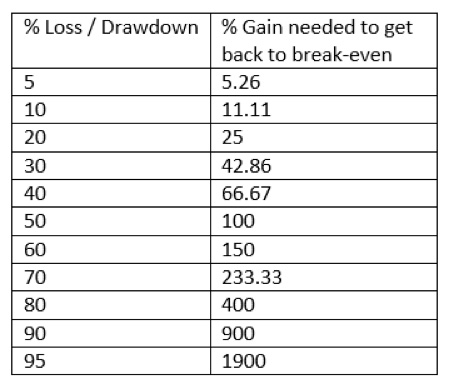

2. Look for traders with low historical drawdowns.

Controlling losses or drawdowns is one of the most important factors in becoming successful in the long term. It may be possible to make 20% or more in a month through high-risk trading, but when those risks do not pay off, you may well find yourself with a 50% loss or more the following month. In the medium to long term, you will usually find that high-risk traders have gone backward. So maintaining low drawdowns through a sensible money management strategy is perhaps one of the most important criteria for long-term success in trading and by default, copying.

Many people don’t consider that you incur a 5% drawdown, so you need to gain 5.26% to get back to break even. However, lose 50%, and you now need a whopping 100% gain just to get back to break even, and with higher drawdowns, the gains needed start to grow exponentially.

I see some traders ask copiers to set the copy stop-loss (CSL) at the maximum level of 95%. Of course, nobody ever expects that they will ever lose that much, but it does happen. By incurring a 95% drawdown, you will need an unlikely 1900% gain just to get back to break even before you can even start making any money.

Here is the cheat sheet for knowing how much gain you need for specific drawdown amounts:

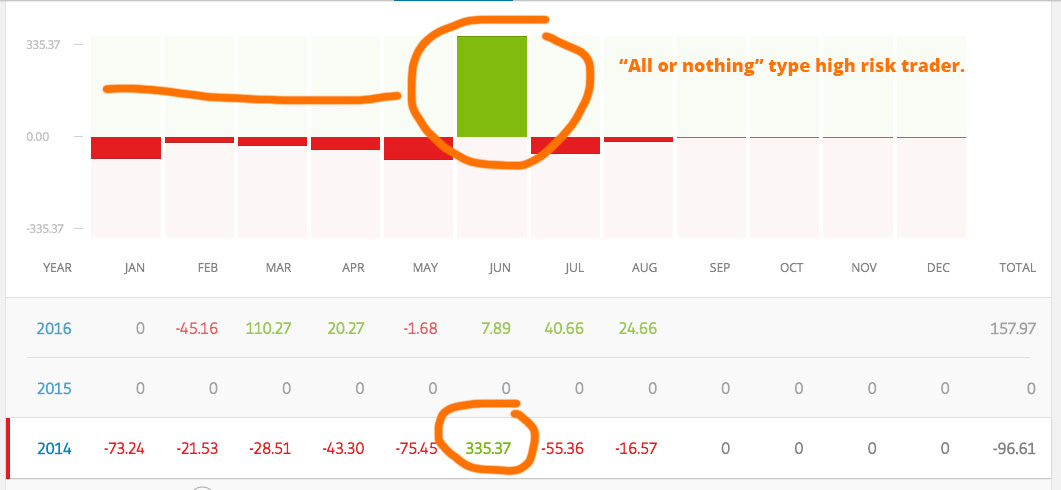

3. Avoid traders with huge percentage gains.

High percentage gains can be a useful indication of high-risk trading since the only way to make excessively large gains is to trade with higher leverage and/or big stakes. This is fine when it goes the right way, but nobody can ever win 100%, and just one bad trade can easily bust a high-risk strategy.

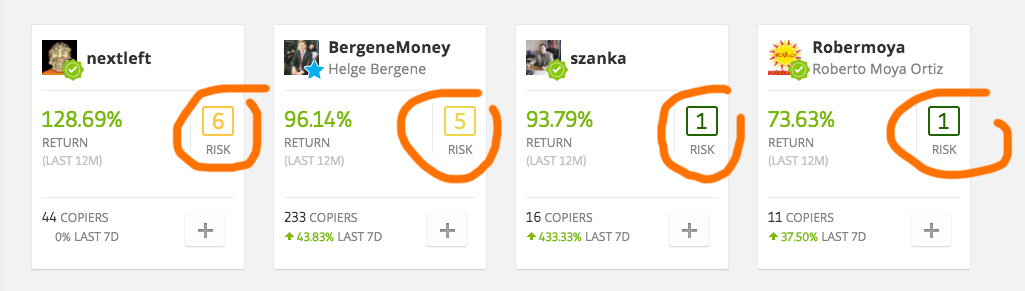

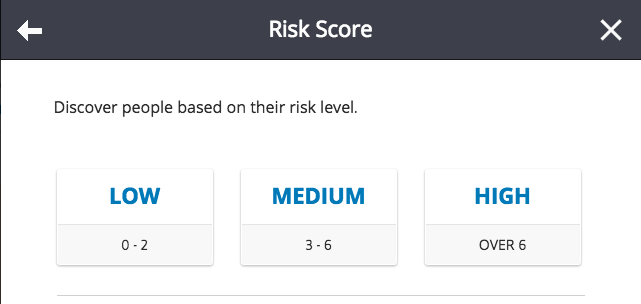

4. Look for a low Risk Score.

Past performance is not an indication of future results. The trading history presented is less than 5 complete years and may not suffice as a basis for an investment decision.

The risk score is not perfect, but it is a useful metric as part of your research into gauging how risky copying a particular trader might be. Large swings in equity, trading with high leverage, and large stakes are all important factors that are taken into consideration within the Risk Score calculation.

Trader risk levels are the following:

- 0-2 – Low risk

- 3-6 – Medium risk

- Over 6 – High risk

It is also important to consider that higher risk does not necessarily mean higher gains over the long term. High-risk trading usually ends in failure.

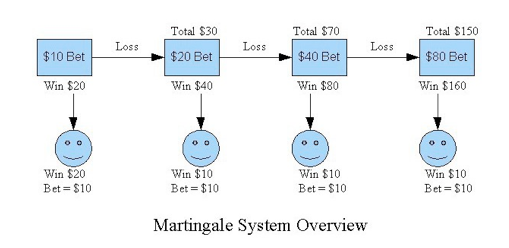

5. Avoid Martingale traders.

Martingale is a process of doubling your bet each time you lose. It is used by gamblers worldwide, usually in 50/50 scenarios such as roulette.

Variations of the fundamentally flawed Martingale betting system have become very popular among inexperienced traders. This is where traders keep averaging down as the market goes against them. Perhaps, only entering trades with as little as 1-2% of equity per trade, but it is not uncommon to see 20-30 losing trades or more running at any one time. This type of high-stakes trading can, of course, can lead to huge swings in equity.

It has become so popular amongst beginners because the system can often appear to have an amazing success rate at first, with historical stats showing 100% winning banked trades. However, take a look at the portfolio of open trades, and you may find many losing open trades.

Martingale traders will run these trades for many months or even years, continuously extending stop-losses in the hope that the trades may eventually be closed even a few pips in profit. The 100% success rate only ends when the trader runs out of funds available to extend stop-losses and loses 100% of equity.

6. Copy in demo mode before committing real cash.

Just as traders must test a trading system to see if it works or not and to fine-tune any flaws, it is highly advisable for copiers to test their copy selections in demo mode before risking any real money.

7. Think about long-term growth and be patient.

We all want to see big profits as soon as we enter a trade, or in this case, a copy. Nobody wants to have to wait. This same issue applies double to copiers who may be new to the whole thing and are excited about the opportunity to become successful traders.

However, constant screen-watching should be avoided. It will drive you crazy as short-term market valuations fluctuate. Sometimes, markets are extremely volatile, and sometimes they can be flat for weeks, perhaps stuck in a range where it is very difficult to find a decent trade. So if you are constantly watching your screens to see how much profits are rolling in from your copy, it can be extremely frustrating when you do not see much movement, or worse, prices may be going against you, causing a bit of drawdown.

After spending a lot of time searching, studying stats, and perhaps copying traders in demo for a period of time, your portfolio should be monitored, but there is no need to obsess over every short-term move and get spooked into jumping from copying one trader to another and then another just because someone recently had a big win. The big win may never be repeated, and it could be that you stopped copying the other traders just as the market takes off in its predicted direction. The worst-case scenario is that you can jump from loss to loss and more losses.

When a trader takes a trade, it is far more advisable to decide in advance how much you are willing to invest, place your copy stop-loss and then be patient as you monitor the situation. Whatever happens with any individual trade, if you have done your research and chosen your trader wisely, you should see what we all want to see: solid, consistent gains giving long-term success.