eToro Social trading network (a.k.a Copy trading platform)

Below content does not apply to US users.

The secret strength of social trading

Do you know what the most important factor for choosing the best broker that almost nobody talks about is?

Commission size? Withdrawal speed? Maximum leverage?

None of the above.

It all comes down to how many users lose money with a particular broker.

Who cares if the withdrawal time is 2 days instead of 1 day if there is a 92% chance that you will lose your money?

The single most telling criterion for the quality of a broker is the percentage of losing accounts. If the losing percentage is higher than the average, it could mean that either the broker is playing against the users, having unreasonably high fees, not providing good enough tools and resources for education and analysis, etc.

We are very lucky today. Why?

Because before 2018, nobody actually knew those losing numbers. Everybody was guessing. The most popular legend was that 96% of all traders lose money.

Then came a big regulatory change and all the brokers now have to display their losing/winning account percentages clearly. (You can read more in the research about what percentage of forex traders are losing money.)

Long story short – ever since the transparency came along, eToro has been on the top with the lowest amount of losing traders.

What makes eToro stand out so much? Given the fact that eToro is geared toward beginner traders, it should be the total opposite. The newbies should be losing much more frequently. The brokers who are specialized for more experienced traders should have come on top. But, for example, FxPro has 79%, and FXCM has 74% losing accounts.

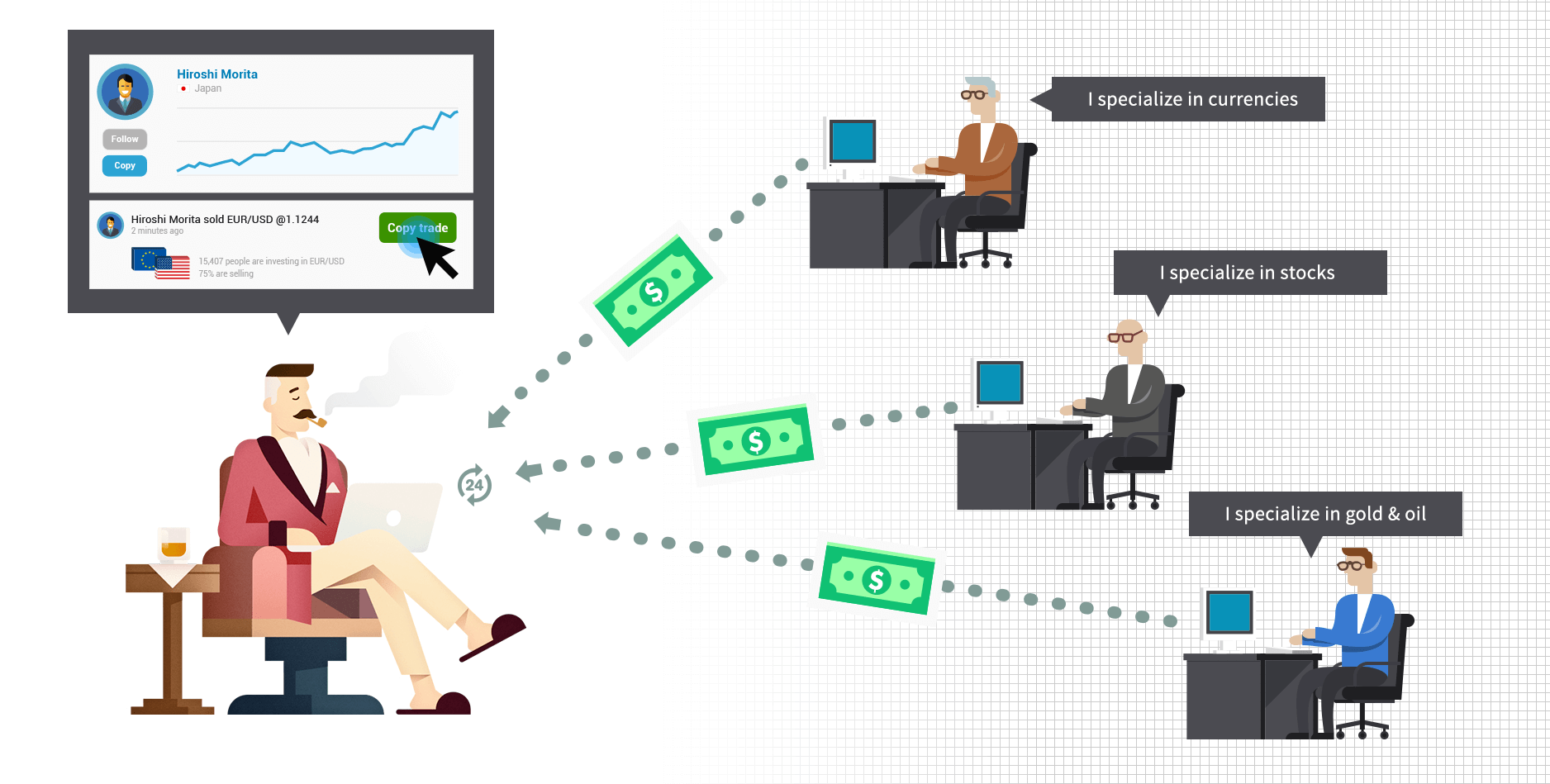

Bottom line: eToro’s strength apparently comes from the Social Trading functionality of its CopyTrader™ and its community of more than 20 million active users. The fact that you are not alone with a confusing chart in front of you but can follow and copy more experienced traders and investors (Popular Investors) obviously works. Numbers speak for themselves.

How social trading killed the king

Imagine that you are looking for an asset manager who would make investments and trades for you. Normally you would go to a bank or a hedge fund to find one.

Here is how it would look:

- You would need at least $20,000 – $100,000 for a good manager to be interested.

- They would charge 15% – 20% of the profits they make for you. (“if” they make it. It’s a big “if”)

- Plus some annual management fees even if they lose your money.

- You would have no clue about their actual performance statistics.

- They would cover you in piles of emails and documents full of non-readable legal jargon.

- They wouldn’t share their trading strategies with you.

- They certainly wouldn’t spend any time teaching you how to trade.

- Fund managers are kings. In a guarded castle. They make money even if they make bad bets on your behalf. And there is nothing you can do to them (if you’re not a popular billionaire).

Not so fun, right?

Popular Investors earn money only if they earn money for their copiers and if they add value by teaching their followers. An important aspect of the success of eToro is that eToro has created a system where Popular Investors are highly motivated to achieve and most importantly sustain high profitability for themselves and their copiers.

The statistics and trades are transparent. If an investor with thousands of followers makes a mistake, he can be sure that many of his followers will ask for explanations. If the investor fails to communicate well and makes those mistakes again then everyone stops following them with one click and the investor stops making money. This transparency and responsibility are what pushes the traders to improve continuously, and thus the overall profits become higher and risk levels lower.

There are some problems, though

As rosy as it all sounds, there are some challenges of course. In the early days of the social trading platform, quite a few investors manipulated their data to make their gains look astronomical. Mainly they did it by never closing the losing trades.

Luckily, eToro has improved the system over the years, and it’s no longer possible to manipulate the statistics like that.

Still, there are other things to keep in mind and look out for:

- Look out for investors who recommend using high Stop-Losses: some investors ask copiers to set the copy stop-loss (CSL) at the maximum level of 95%. Of course, nobody ever expects that they will ever lose that much, but it does happen. By incurring a 95% drawdown, you will need an unlikely 1900% gain to get back to break even before you can even start making any money.” Remember that Stop Loss and Take Profit are not guaranteed and trading with leverage involves high risk.

More on this you can read in 10 little-known tips on how to find the best traders on eToro.

- Don’t put all your eggs in one basket: Investing in people, just like investing in assets, involves risk. Therefore, it is important to diversify your people-based portfolio with several traders who invest in different assets, and have different strategies, to spread out your risks.

- It’s not easy to find the best investors: Some Popular Investors have a long-term strategy, which could include some losses. And yet, some copiers are easily deterred by such losses and stop copying a trader if they lose without seeing the entire cycle through.

How much money do the eToro popular investors make?

The compensation structure is directly linked to the quality of a Popular Investor’s decisions and performance.

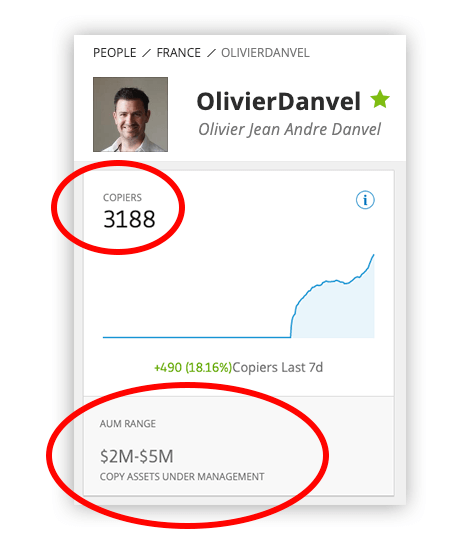

Here’s what a popular investor can earn: For the sake of example, let’s take a random trader with a large number of copiers and the Assets Under Management (AUM):

As we can see, Olivier has a pretty impressive AUM: $2 million – $5 million. Let’s assume that he manages an average of $3 million of copier assets annually. And let’s also assume that he has reached the ELITE level and his own account has a minimum average equity of $20,000.

In this case, Olivier could be making $72,000 per year ($6,000 per month) on top of the profits from his own trading. It would consist of the following:

- Fixed payment of $1,000 per month

- And 1.5% of the annual average AUM

Not too shabby, right? But as mentioned before, it takes a lot of hard work to maintain great results and followers/copiers.

___

This example is hypothetical. Past performance is not an indication of future results. This is not investment advice.

___

If you are interested in becoming a popular investor or simply for more info, you can have a look at the Popular Investor program.

If you are interested in learning more about forex, you might enjoy Forex Hero – the free learning app full of beginner tips and tricks.

________

Disclaimer:

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.